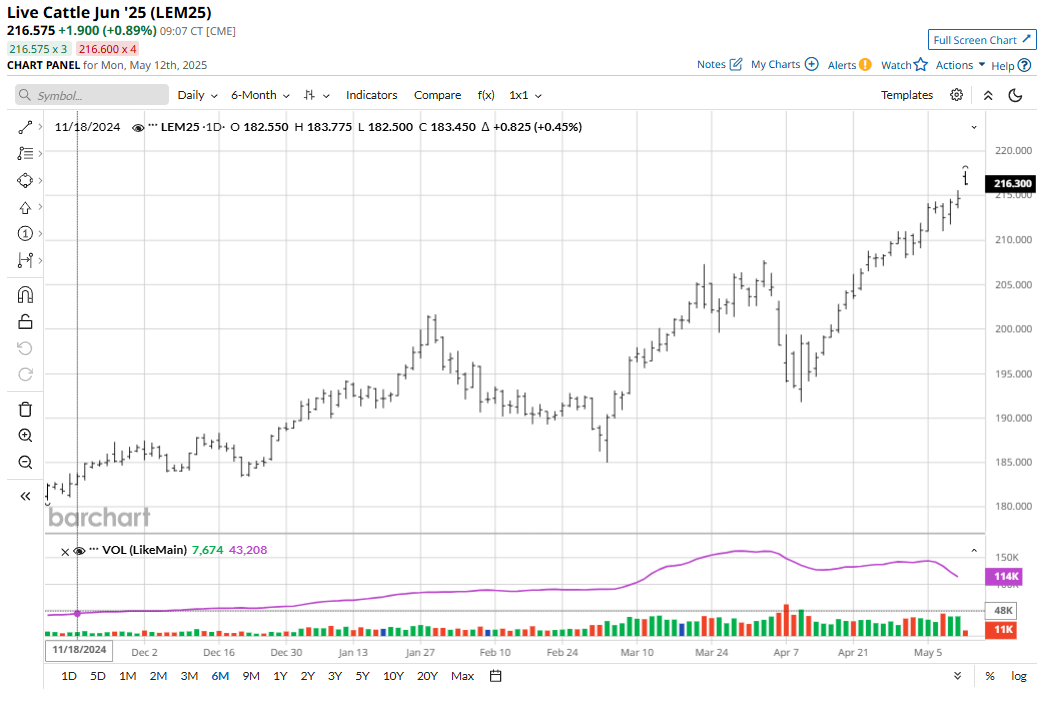

Mooooonshot in Cattle Futures Prices. Can the Rally Continue?

June live cattle futures (LEM25) Friday hit a contract high of $215.60 a hundredweight. In late April, nearby live cattle futures hit a record high of $217.675. The feeder cattle futures (GFQ25) market last week hit a record high of $298.50 a hundredweight, basis the nearby contract.

How Long Can Cattle Futures Prices Keep Trending Up?

The strong bull market stampede in cattle futures rolls on, with no solid, early chart clues to suggest market tops are close. This is despite both live and feeder cattle futures being in very mature phases of their bull runs. The fact that live cattle and feeders have seen relatively low volatility in their present, record-setting up-moves suggests more of the same price action for at least the near term.

A few early clues the cattle futures markets have finally topped out would be:

- Two big down days of price action in a row.

- A bearish “key reversal” down on the daily bar chart, whereby prices score a new for-the-move high and then promptly reverse course to close lower, while also seeing a higher high and lower low than the previous session’s price action.

- A significant increase in daily volatility that includes bigger daily price bars, which would signal a climaxing price move.

Cash Cattle and Beef Market Fundamentals Remain Strong

Live cattle futures and feeders were posting solid gains on Monday morning and hit contract and records highs as a closure of the southern border of Mexico is likely to continue to boost cattle futures prices. USDA Secretary Brooke Rollins on Sunday announced the suspension of live cattle, horse, and bison imports through ports of entry along the U.S.-Mexico border in response to the rapid northward advance of the New World screwworm (NWS) in Mexico.

Cash cattle trading commenced last Friday in heavier volumes at sharply higher price levels than seen earlier in the week in lighter volumes. That brought steers late last week to average $224.49 and heifers to average $221.96, according to the USDA. The prior week’s USDA-reported average cash cattle trading price was a record $220.97. The USDA noon report Friday showed wholesale boxed beef values still solid, with Choice grade beef at $346.53 and Select grade at $332.52. Those are lofty values and suggest solid consumer demand for beef at the meat counter.

Peak outdoor grilling season is right around the corner, suggesting retailer and consumer demand for beef will remain strong. At the same time, cattle on U.S. feedlots continue to show historically tight supplies. Feedlots are adding to cattle weights to meet the strong retail and consumer demand for beef. Latest steer carcass weights were unchanged at 946 pounds from the week prior but 26 pounds above year-ago and 47 pounds above the five-year average. The added weight is helping packers offset sharply reduced slaughter levels. Packers have secured hefty supplies of late, with the availability of May contracted supplies easing some near-term supply concerns. Still, all the above point to elevated cattle and beef prices in the coming weeks.

The Macroeconomic Picture Needs to Be Upbeat to Extend Cattle Futures Rallies

The cattle and beef markets are also likely to be impacted in the coming few months by the health of the U.S. economy, which in turn impacts consumer confidence and spending. U.S. data recently has been mostly positive for the economy. Also, the U.S. stock indexes have made dramatic recoveries from their early April swoons.

However, there could be storm clouds on the horizon for the U.S. economy. The negative economic impact of the U.S.-China trade war on both countries is very evident when examining ocean shipping volumes. Bloomberg recently reported a one-third drop in import volumes coming into The Port of Los Angeles, which is the busiest container port in North America. A shipping CEO told Bloomberg that ocean shipping from China is down 60%. In the coming weeks there will likely be a serious negative ripple effect on the many U.S. businesses that deal in imports. It may not be long until product shortages start showing up on retailer shelves. Although the U.S. and China agreed to a 90-day pause on most tariffs, transportation officials have said the turnaround time to reestablish supply chains will be substantial. Dramatically reduced ocean shipping coming into U.S. ports just recently may be an ominous precursor to some product shortages on U.S. retailer shelves and corresponding higher prices.

The above scenario could kill the record-setting bull runs in cattle and beef markets. A good gauge of U.S. economic health and consumer confidence is the U.S. stock market. The recent strong rallies in the U.S. stock indexes are so far not painting a dour picture for the U.S. economy in the coming months. Cattle traders will continue to monitor the price trends in the U.S. stock Indexes in the coming weeks.

Tell me what you think. Email me at jim@jimwyckoff.com.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.