Do Wall Street Analysts Like News Corporation Stock?

With a market cap of $16.1 billion, News Corporation (NWSA) is a global, diversified media and information services company, operating across the United States, Canada, Europe, Australasia, and beyond. Its five segments: Digital Real Estate Services; Dow Jones, Book Publishing; News Media; and Other, span leading brands, platforms, and properties in news, entertainment, publishing, and digital marketplaces.

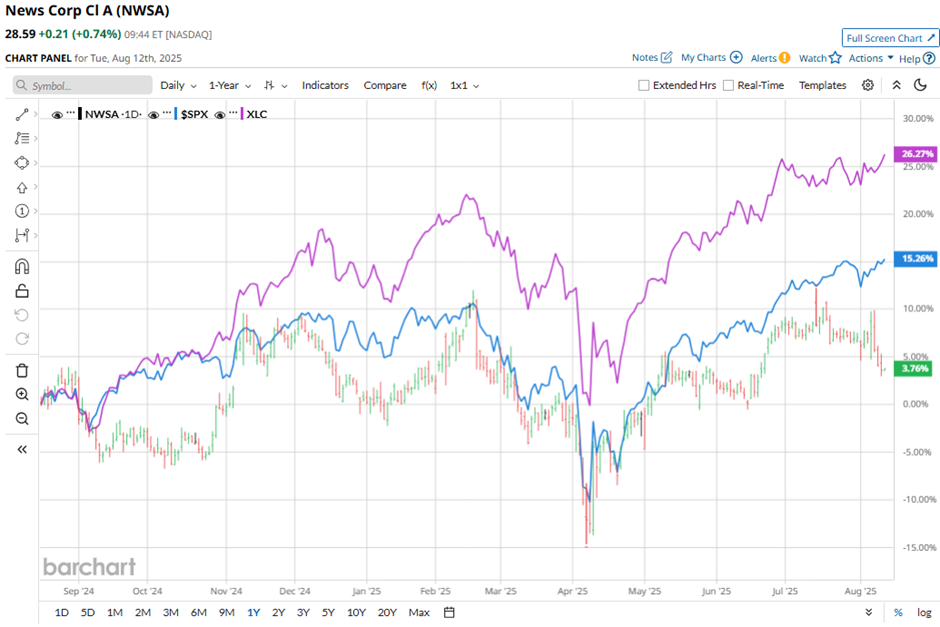

Shares of the New York-based company have underperformed the broader market over the past 52 weeks. NWSA stock has gained 4.7% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 19.3%. Moreover, shares of News Corporation are up 3.1% on a YTD basis, compared to SPX’s 8.4% rise.

However, the publishing company stock has lagged behind the Communication Services Select Sector SPDR ETF Fund’s (XLC) 28.6% gain over the past 52 weeks.

Shares of NWSA recovered marginally following its Q4 2025 results on Aug. 5 as revenue of $2.1 billion slightly beat the estimate, driven by a 6.7% revenue increase at Dow Jones and a 7% rise in consumer subscriptions to 6.3 million, with digital circulation revenue up 10%. Strong results in the digital real estate services unit, where revenue rose 4% on price increases, also supported sentiment.

For the fiscal year ending in June 2026, analysts expect NWSA's EPS to grow 15.7% year-over-year to $1.03. The company's earnings surprise history is mixed. It beat or met the consensus estimates in three of the last four quarters while missing on another occasion.

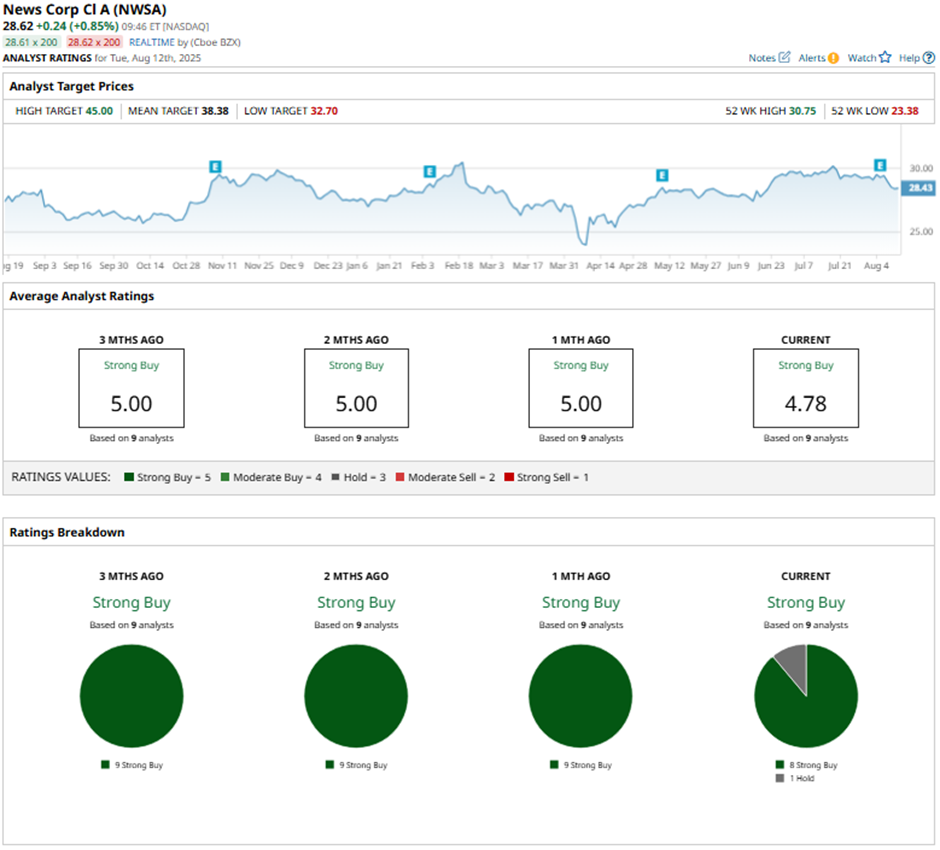

Among the nine analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on eight “Strong Buy” ratings and one “Hold.”

On Aug. 6, Macquarie analyst David Fabris downgraded News Corp. to “Neutral” from “Outperform” and cut its price target to $32.70.

As of writing, the stock is trading below the mean price target of $38.38. The Street-high price target of $45 implies a potential upside of 57.2% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.