Uber’s Rally Takes a Breather. Could the Next Move Higher Be Even Bigger?

/Uber%20Technologies%20Inc%20logo%20outside%20offices-by%20Sundry%20Photography%20via%20iStock.jpg)

Uber (UBER) is one of the top-performing large-cap stocks in 2025. The stock has surged 53% year-to-date, far outpacing the S&P 500 Index ($SPX), which is up 9% over the same stretch. The rally has been driven by strong business momentum, reflected through steady growth in trips and gross bookings with robust demand for both its ride-hailing and delivery services. Moreover, its unique positioning in the fast-evolving autonomous vehicle industry further pushed its share price higher.

Yet after months of momentum, Uber’s stock seems to have paused for breath. Over the past month, shares have slipped more than 3%, even as the company’s second-quarter results on Aug. 6 beat Wall Street’s expectations.

The lack of an immediate post-earnings bounce raises questions about whether Uber’s rally is running out of fuel or if it’s simply the calm before another big move. Let’s take a closer look.

Uber’s Core Growth Drivers Still Intact

Uber stock may have taken a breather after a strong run, but the company’s core growth drivers remain solid. Moreover, the company’s latest quarterly numbers show that Uber’s business is firing on multiple cylinders.

In the second quarter, both trips and gross bookings surged 18% year-over-year, reflecting resilient demand across Uber’s diversified platform. The company’s monthly active platform consumers (MAPCs) climbed to a record 180 million, up 15% from a year earlier. Notably, engagement on its platform has increased, and on the supply side, Uber reported 8.8 million active drivers and couriers worldwide, marking a 20% annual increase.

Uber’s ability to use its mobility and delivery platforms as a gateway to attract new customers, convert them into cross-platform users, and deepen engagement over time is paying off well. Notably, customers who use both services have retention rates more than 35% higher than single-service users and generate over three times the gross bookings. Yet, the opportunity is far from fully realized, with fewer than one in five eligible customers active on both platforms, leaving a vast runway for growth.

The company’s subscription program, Uber One, has also become a powerful driver of engagement. Membership hit over 36 million in June, up roughly 60% year-over-year, and now accounts for more than 40% of combined mobility and delivery gross bookings. Retention rates remain strong, with new members sticking around at levels similar to long-term subscribers. Uber also continued to expand Uber One’s reach, launching in Argentina and rolling out mobility benefits in seven additional countries during the quarter.

Uber’s core ride-hailing business continues to deliver steady gains, with trips growing 19% year-over-year for the fourth consecutive quarter. The segment is benefiting from competitive pricing, a focus on deepening customer engagement, and expansion into suburban markets. Affordable ride options are also helping Uber tap into more price-sensitive customers, further expanding market share.

On the delivery side, momentum is equally robust. Delivery trips rose 17% year over year, while gross bookings jumped 20%, driven by membership growth and healthy grocery & retail (G&R) revenue performance. There’s still plenty of room to expand, as around 30% of eligible ride-hailing customers have never used Uber’s delivery services, and roughly 75% haven’t tried its G&R options yet.

Looking ahead, Uber is also well-positioned to capitalize on the evolving autonomous vehicle (AV) market. With its massive 180 million monthly active users, Uber is in a solid position to serve as the leading marketplace connecting AV supply with rider demand. Its high-utilization network offers AV manufacturers an attractive platform to maximize efficiency and occupancy. Uber has already partnered with 20 AV companies across Mobility, Delivery, and Freight, and is actively working to put more autonomous vehicles on its network.

What’s Next for Uber Stock?

While the rally in Uber stock has hit a pause, its growth engine is still running at full speed with multiple levers, from cross-platform engagement to autonomous vehicle partnerships, poised to drive the next phase of expansion.

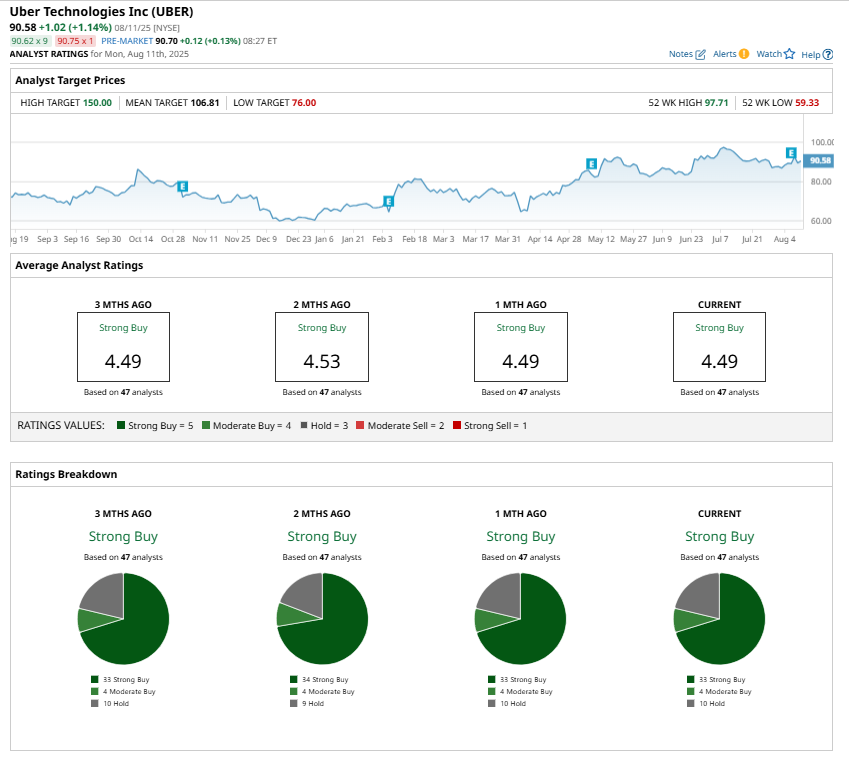

Wall Street remains bullish on Uber. Analysts maintain a “Strong Buy” consensus rating, pointing to further growth ahead. The highest price target on the Street stands at $150, suggesting potential 65% upside from current levels.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.