George Soros Is Betting Big on Beaten-Down UnitedHealth Stock. Should You?

/Unitedhealth%20Group%20Inc%20HQ%20photo-by%20jetcityimage%20via%20iStock.jpg)

UnitedHealth (UNH) is an American multinational healthcare and insurance company headquartered in Minnesota, ranking among the world’s largest healthcare service providers. The company has two primary divisions, namely UnitedHealthcare, which oversees health benefit plans for its clients, and Optum, which provides data analytics, delivery solutions, and more.

About UnitedHealth Stock

So far, UNH stock has really struggled this year, down 39% year-to-date (YTD) while also lagging behind the S&P 500’s gain of about 9%. In the 52-week period, it has lost close to 47% of its value, with the stock being 51% below its 52-week-high.

Following a difficult period, shares rebounded over 12% in the last week after Berkshire Hathaway (BRK.A) (BRK.B) increased its stake, signaling some renewed investor confidence despite broader turbulence.

Building on this momentum, UnitedHealth is experiencing a 1.5% gain today and about an 8% increase in a month.

UnitedHealth Misses Q2 Targets

UnitedHealth’s second quarter 2025 results fell short of expectations. Earnings came to $4.08 per adjusted share, missing the Zacks Consensus Estimate of $4.84 and declining 40% year-over-year (YOY). Revenue rose to $111.6 billion, a 12.9% YOY increase that slightly beat consensus expectations by 0.1%. Despite the top-line beat, profit was pressured by elevated medical costs, with a medical care ratio of 89.4%, higher than both the consensus and prior year, leading to a net margin drop to 3.1%.

Operating earnings were $5.2 billion, down 34.6% YOY, and total operating expenses surged 17% to $106.5 billion. The cost jump was driven by increased medical costs, hitting $78.6 billion, and higher product expenses. UnitedHealth’s health benefits arm, UnitedHealthcare, posted revenue of $86.1 billion, while Optum contributed $67.2 billion.

It ended the quarter with a cash reserve of $32 billion, up from $29.11 billion at the end of 2024.

Looking ahead, UnitedHealth management now forecasts adjusted net EPS of at least $16 for 2025, a sharp reduction from its previous $26 to $26.50 projection. The company’s revenue outlook has improved, with expected revenues between $445.5 billion and $448 billion, up from $400.3 billion in 2024.

Consequently, management cautioned that elevated medical costs will likely persist, putting pressure on profit growth and margins throughout the remainder of 2025.

Hedge Funds Boost UnitedHealth

During the second quarter, both Soros Fund Management and Appaloosa Management significantly increased their holdings in UnitedHealth, reflecting renewed investor interest amid a challenging year for the health-insurance giant.

Appaloosa Management made a substantial move, purchasing approximately 2.28 million shares of UnitedHealth, marking a dramatic 1,300% increase in its stake. This buy raised its total holdings to 2.45 million shares. Similarly, Soros Fund Management added 28,900 shares during the quarter, bringing its total to 990,292 shares, further bolstering its position in the company.

Further, both funds also increased their stakes in Nvidia (NVDA). Soros bought up 932,539 shares, while Appaloosa added 1.45 million shares of the leading chipmaker.

The large-scale purchases of UnitedHealth shares by these high-profile investors suggest confidence in the company’s long-term prospects despite near-term challenges, indicating a potential inflection point for the beleaguered insurer.

Should You Buy UNH Stock?

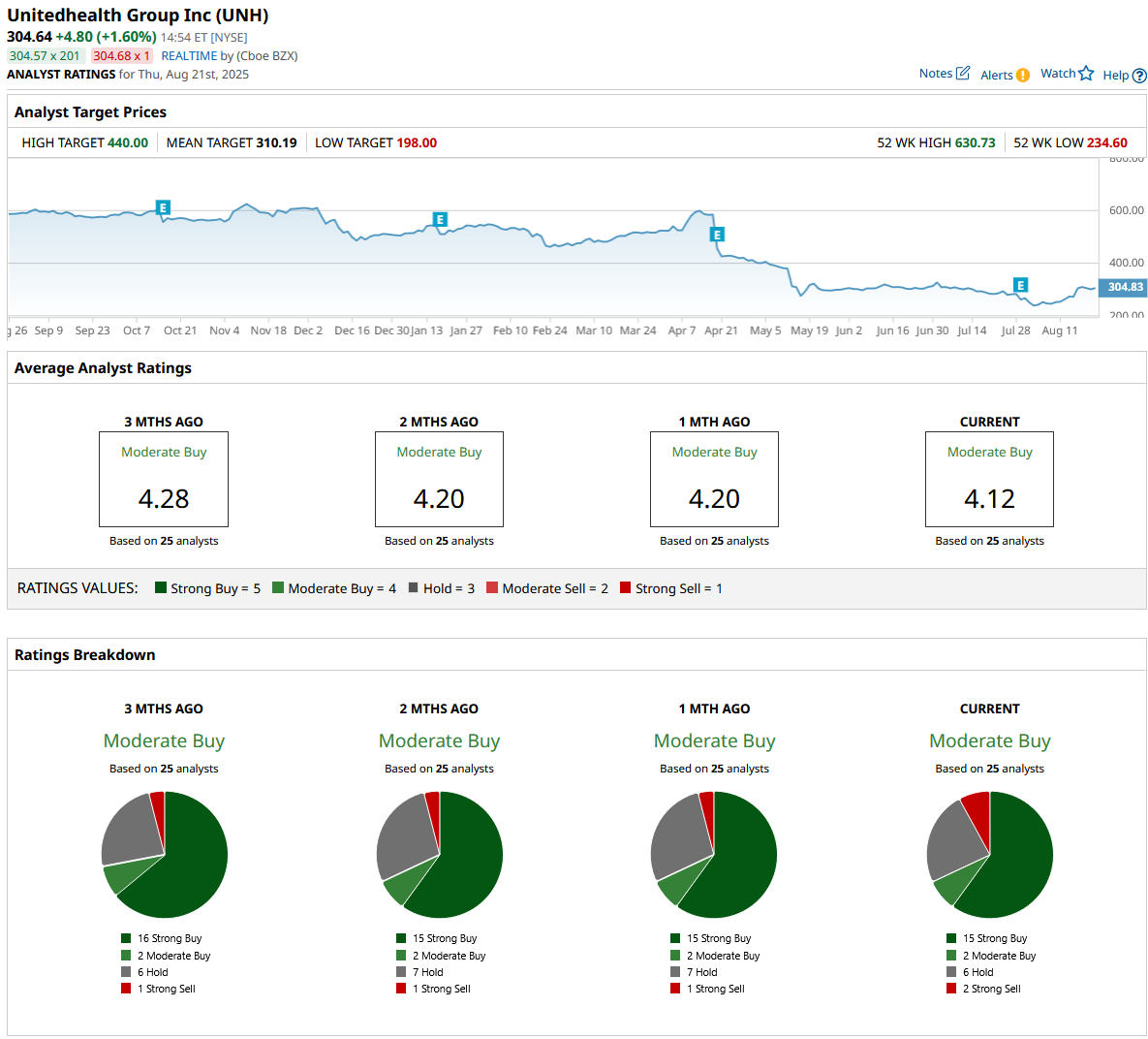

Amid the volatility, UnitedHealth has received a mixed bag of ratings from analysts. The company has a consensus “Moderate Buy” rating with an average price target of $310.19, reflecting a 2% upside to the market price.

UnitedHealth has been appraised by 25 analysts so far with 15 “Strong Buy” ratings, two “Moderate Buy” ratings, six “Hold” ratings, and two “Strong Sell” ratings.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.