Advanced Micro Devices Stock: Is AMD Outperforming the Technology Sector?

/Advanced%20Micro%20Devices%20Inc_%20logo%20and%20chart%20data-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

Valued at $263.9 billion by market cap, Advanced Micro Devices, Inc. (AMD) is a prominent semiconductor company that designs and develops high-performance processors, graphics cards, and adaptive computing solutions. Headquartered in Santa Clara, California, AMD serves markets spanning PCs, gaming, data centers, and embedded systems, competing with Intel and NVIDIA through innovations in CPUs, GPUs, and AI-driven technologies.

Companies worth $200 billion or more are generally described as “mega-cap stocks,” and AMD perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the semiconductor industry.

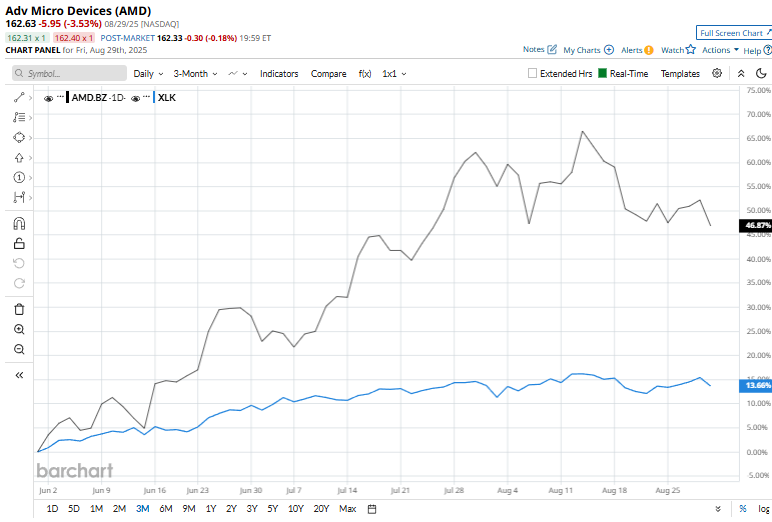

Despite its notable strength, AMD slipped 12.9% from its 52-week high of $186.65, achieved recently on Aug. 13. Over the past three months, AMD stock soared 43.9%, outpacing the Technology Select Sector SPDR Fund’s (XLK) 13.3% returns over the same time frame.

Moreover, shares of AMD have surged 34.6% over the past 52 weeks and 11.1% in 2025, compared to XLK’s YTD rise of 12.9% and 19.6% returns over the last year.

To confirm the bullish trend, AMD has been trading above its 50-day moving average since early May and over its 200-day moving average since mid-June.

On Aug. 5, AMD reported its Q2 results, and its shares popped over 6% in the following trading session. The company reported adjusted EPS of $0.48, slightly above Wall Street’s estimate of $0.47, and revenue of $7.7 billion also topped forecasts of $7.4 billion. For Q3, AMD projects revenue between $8.4 billion and $9 billion, signaling confidence in continued growth.

In the competitive semiconductor arena, top rival NVIDIA Corporation (NVDA) has taken the lead over AMD, showing resilience with a 29.7% rise on a YTD basis and a 38.7% uptick over the past 52 weeks.

Wall Street analysts are moderately bullish on AMD’s prospects. The stock has a consensus “Moderate Buy” rating from the 44 analysts covering it, and the mean price target of $189.65 suggests a potential upside of 16.6% from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.