Analysts Think This Quantum Computing Stock Has ‘Compelling’ Potential. Should You Buy It Now?

/Quantum%20Computing/Image%20by%20Funtap%20via%20Shutterstock.jpg)

While the hype around artificial intelligence (AI) hasn’t even settled, excitement is now shifting toward quantum computing, the next big tech frontier. And IonQ (IONQ) is emerging as a clear beneficiary. As one of the few pure-play quantum stocks, it’s earning attention from growth investors looking for the next big opportunity in the tech space. The company’s edge lies in its trapped-ion technology, an approach praised for scaling qubits while keeping error rates low, two of the biggest challenges in building practical quantum systems.

With quantum advances widely viewed as the next major leap in computing power, IonQ’s distinct position in the industry has attracted strong interest from growth-oriented investors. Wall Street is also beginning to take notice. B. Riley recently launched coverage on the company, citing “compelling” long-term growth prospects, with analyst Craig Ellis calling IonQ the revenue growth leader in the quantum computing space. Having said that, is now the right time to bet on IONQ shares?

About IonQ Stock

IonQ is at the forefront of quantum innovation, building on more than two decades of academic research to advance trapped-ion quantum computing. Unlike competing methods, IonQ’s approach harnesses ionized atoms, enabling longer, more precise computations with significantly fewer errors.

The company has rapidly emerged as a frontrunner in the quantum race, with its Forte and Forte Enterprise systems already boosting performance for major partners like Amazon’s (AMZN) AWS, AstraZeneca (AZN), and Nvidia (NVDA). Looking ahead, the company has set an ambitious target of reaching 2 million qubits by 2030, positioning itself to solve complex problems across industries ranging from drug discovery to national defense.

With a market capitalization of about $12.3 billion, IonQ has been nothing short of a market standout. Over the past year, its stock has skyrocketed a stunning 509%, dwarfing the broader S&P 500 Index’s ($SPX) 15.4% gain. While momentum cooled this year, with shares dipping marginally year-to-date (YTD), the tide has turned in recent months. In the past six months, IonQ has staged a sharp comeback, surging nearly 73.8% and rising 7.3% over the last five days.

Inside IonQ’s Q2 Earnings Report

IonQ released its fiscal 2025 second-quarter earnings report on Aug. 6, which revealed strong top-line growth and a clear push to scale. For the quarter, the quantum computing company reported a revenue of $20.7 million, marking a remarkable 82% year-over-year (YoY) rise. To put that in perspective, revenue more than doubled from Q1’s $7.6 million, signaling that demand for its quantum offerings is accelerating at a blistering pace.

That kind of growth firmly positions IonQ as one of the fastest-scaling names in the quantum computing space. In fact, the reported topline figure in Q2 not only sailed past Wall Street’s $17.2 million estimate but also beat management’s higher-end revenue guidance by a notable 15%. Of course, rapid expansion comes at a cost.

Operating expenses surged to $181.3 million, up more than 200% from last year, as the company poured resources into R&D, sales, and talent acquisition. That translated into a loss per share of $0.70, far wider than the loss of $0.18 per share recorded in the year-ago quarter and significantly missed Wall Street’s forecasted loss of $0.13 per share. A closer look at IonQ’s expenses shows exactly where the company is doubling down.

R&D costs surged a whopping 231% annually to $103.4 million, a clear indication that IonQ is willing to invest heavily to stay ahead in the quantum race. Meanwhile, Sales and marketing jumped 77% YOY to $10.9 million, reflecting its push to expand commercial adoption. Strategic acquisitions such as Lightsynq, Oxford Ionics, and Capella Space are laying the groundwork for what could be the most ambitious roadmap in the industry.

The company is targeting 800 logical qubits by 2027 and an astounding 80,000 by 2030, a trajectory that cements its role as a frontrunner in the quantum race. As of June 30, the company had $656.8 million in cash and equivalents, a figure that jumped to $1.6 billion pro forma after completing a $1 billion equity raise in July. That gives IonQ one of the strongest balance sheets among quantum peers, providing a long runway to fund heavy R&D, pursue acquisitions, and invest in commercialization.

Yet, the raise also puts the spotlight on potential share dilution and the long wait for profitability. Looking ahead, IonQ raised its full-year 2025 revenue guidance range between $82–$100 million and expects Q3 revenue of $25–$29 million, suggesting momentum is only building.

What Do Analysts Think About IONQ Stock?

IonQ captured investors’ attention on Aug. 27 after B. Riley launched coverage, highlighting the company’s “compelling” long-term growth trajectory. Analyst Craig Ellis highlighted IonQ’s status as the revenue growth leader in quantum computing, tracking a third consecutive year of roughly 100% YoY gains, and projected that the company could surpass $1 billion in revenue by 2030.

Ellis set a “Buy” rating with a $61 price target, underscoring confidence in IonQ’s potential to dominate its fast-emerging sector. The analyst further noted that IonQ’s $1.6 billion pro forma cash balance, which represents approximately 12% of its market capitalization, is a key strength that enables the company to aggressively fund R&D, acquisitions, and commercialization while building a path to late-decade profitability.

Ellis added that the product pipeline looks promising, with a fifth-generation system set to launch, positioning IonQ to capture a meaningful slice of what could become a $10–15 billion total addressable market (TAM) within five years. Adding to the bullish setup, IonQ boasts an experienced leadership team with a blue-chip pedigree, a patent-rich technology portfolio, and products that continue to scale toward commercially advantaged releases, such as its upcoming 64-qubit data center systems.

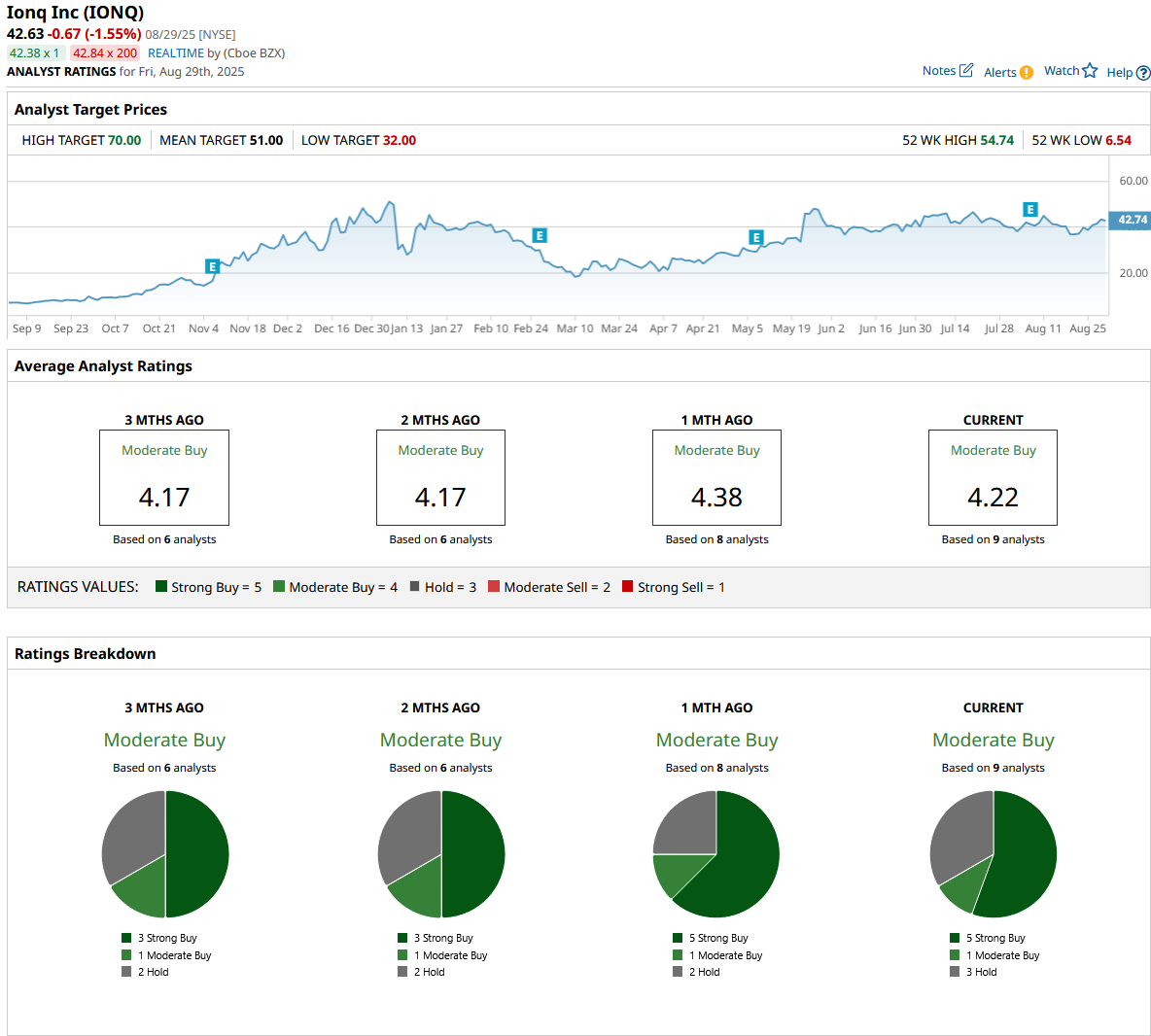

IonQ continues to draw confidence from Wall Street, earning a consensus “Moderate Buy” rating overall. Out of nine analysts offering recommendations, five are firmly in the “Strong Buy” camp, one calls it a “Moderate Buy,” and three maintain a more cautious “Hold” stance. The average analyst price target of $51 suggests 19% potential upside from current levels. However, the Street-high target of $70 indicates that IONQ can rally as much as 64% from here.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.