This Quantum Computing Stock Is Poised to Dominate. Why Analysts Think You Should Buy It Here.

/Quantum%20Computing/A%20concept%20image%20showing%20a%20ray%20of%20light%20passing%20through%20cyberspace_%20Image%20by%20metamorworks%20via%20Shutterstock_.jpg)

IonQ (IONQ) is a pioneering quantum computing company driving the industry forward with its advanced trapped-ion quantum computers and quantum networking solutions. IonQ delivers cloud-based quantum access to businesses globally via major platforms such as Amazon (AMZN) AWS, Microsoft (MSFT) Azure, and Google (GOOG)(GOOGL) Cloud, remaining at the forefront of quantum innovation and financial headlines.

Founded in 2015, the company is based in College Park, Maryland.

IonQ Outperforms Market

IONQ stock has surged remarkably over the past year, outperforming the broader market and the Russell 2000 Index (IWM). Over the last five days, IonQ rose 16.49%. In the past six months, it surged 76.2%, and the stock amassed a whopping 517% in the 52-week timeframe. In contrast to its benchmark, the Russell 2000 posted 4.6% in the last five days and 9.5% in the last year. IonQ’s volatility is higher, offering outsized growth but increased risk compared to its benchmark.

IonQ’s Q2 Results

IonQ’s second quarter of 2025 highlighted impressive revenue momentum, reporting $20.7 million, a stark jump of 82% compared to last year and outpacing analysts by over 20%. Despite beating revenue expectations, the company’s net loss per share deepened to ($0.70), notably worse than the consensus estimate of ($0.29) and last year’s ($0.18). This larger-than-expected deficit overshadowed positive sales growth and led to a negative market reaction focused on profitability challenges.

Examining further financials, IonQ’s operating expenses ramped up to $181.3 million, bringing the operating loss to ($160.6) million, both rising sharply over Q2 2024. Net losses ballooned to $177.5 million from $37.6 million in the prior year. The company recorded adjusted EBITDA of ($36.5) million, while operating margin declined steeply to (776%) versus (430%) last year. Free cash flow finished at ($90.99) million.

IonQ closed the quarter with $656.8 million in cash and equivalents, a 63% increase year-on-year (YoY), supplemented by a $1 billion equity raise that boosted pro forma cash to $1.6 billion.

Looking forward, IonQ’s management upgraded its full-year revenue projection to a midpoint of $91 million, above previous guidance of $85 million, with third-quarter revenues anticipated between $25 and $29 million. The team expects ongoing substantial losses due to heavy investment in research and integration, but remains optimistic that recent acquisitions and capital infusions will drive technological progress and establish market leadership.

Fresh Rating on IonQ

The quantum computing sector is gaining momentum, and IonQ stands out as a leading contender set to dominate the market. IonQ aims to become the “Nvidia of quantum computing,” according to CEO Niccolo de Masi. The company has attracted attention from analysts such as B. Riley’s Craig Ellis, who initiated coverage with a “Buy” rating and a $61 price target, signaling 47% upside from current levels.

Ellis highlights IonQ’s experienced leadership team, including de Masi and recent hire Marco Pistoia, as key drivers behind its growth. Since December 2024, IonQ has closed four major deals, with a fifth pending, while expanding its computing, networking, and space capabilities. Notably, IonQ’s intellectual property portfolio now boasts over 1,000 patents, reflecting its deep expertise and broad industry reach.

With a pro forma cash balance of $1.6 billion (about 12% of its market cap), IonQ is financially well-equipped to pursue profitability by the late 2020s. Its diverse revenue streams – from consulting to quantum computing as a service – fuel ongoing commercial adoption and ecosystem growth. Analysts believe IonQ could capture 15% to 40% of the booming quantum computing market by 2035.

Should You Buy IONQ stock?

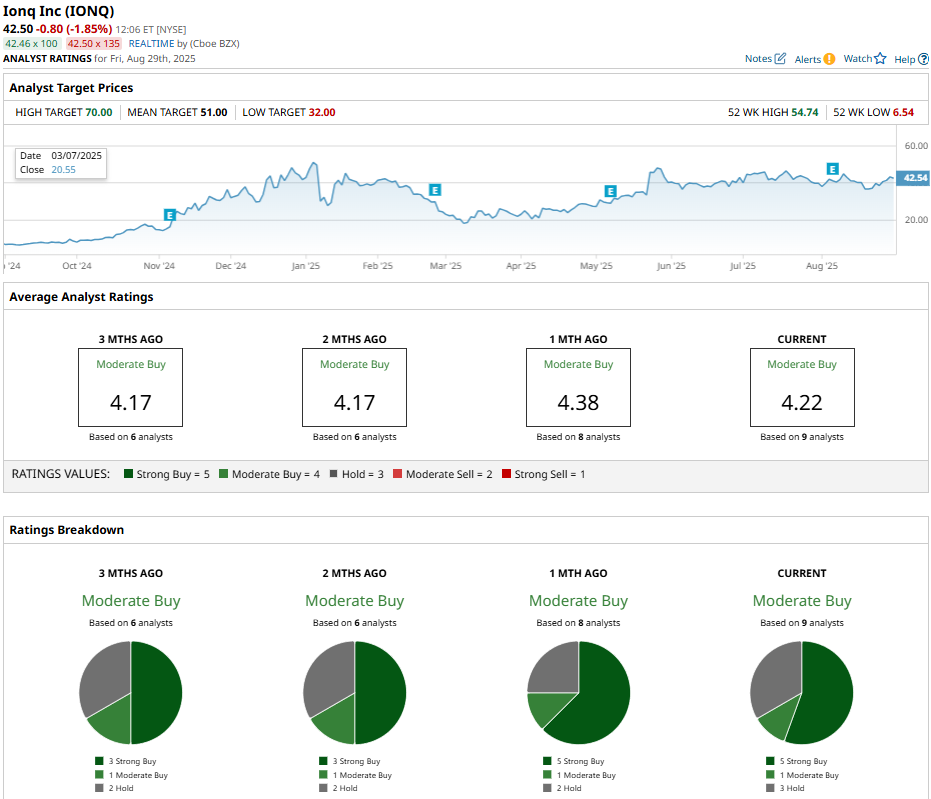

Analysts have a “Moderate Buy” consensus rating on the quantum computing stock with a mean price target of $51, reflecting an upside potential of 21% from the market rate.

IONQ stock has been reviewed by nine analysts while receiving five “Strong Buy” ratings, one “Moderate Buy” rating, and three “Hold” ratings.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.