Caterpillar Stock: Is CAT Outperforming the Industrial Sector?

/Caterpillar%20Inc_%20sign%20on%20building-by%20Jonathan%20Weiss%20via%20Shutterstock.jpg)

Caterpillar Inc. (CAT), based in Irving, Texas, with a market capitalization of about $196.3 billion, is a global powerhouse in the heavy construction machinery industry. The company designs and produces a wide range of products, including construction and mining equipment, diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives. Beyond manufacturing, Caterpillar also supports customers with financing solutions and insurance services, reinforcing its integrated business model.

Companies with a market cap of $10 billion or more are typically classified as “large-cap stocks,” a category that represents established businesses with significant financial strength and global influence. Caterpillar fits comfortably into this category, underscoring its scale, stability, and competitive edge. This status highlights the company’s entrenched leadership in the farm and heavy construction equipment market, where its strong brand recognition, extensive dealer network, and commitment to innovation reinforce its dominance and growth potential.

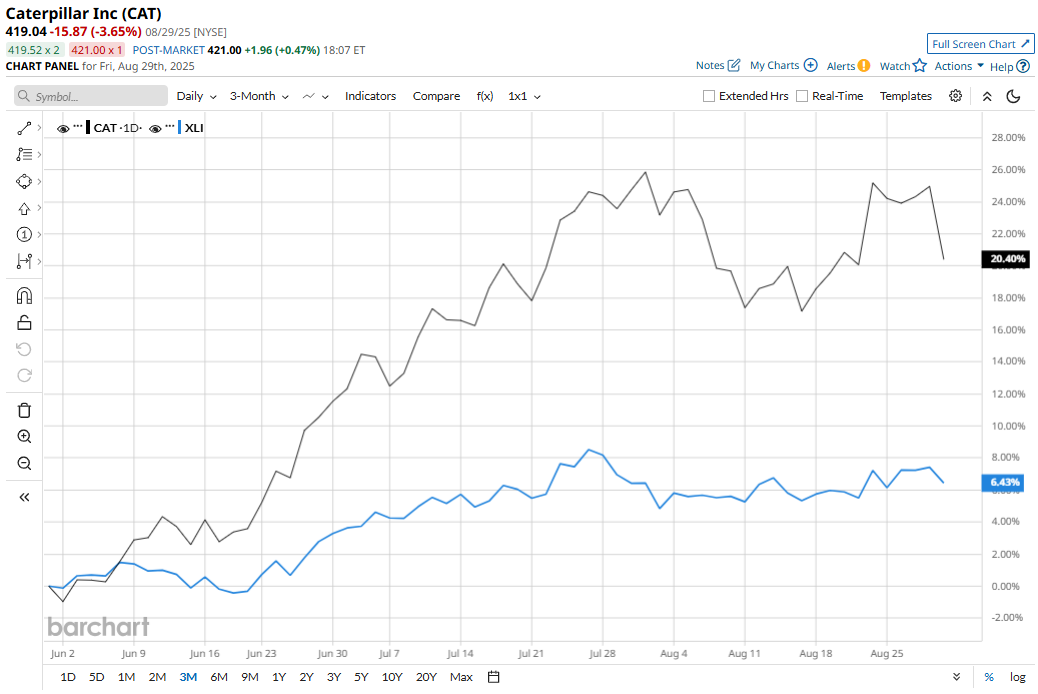

Caterpillar is sitting around 5% below its 52-week high of $441.15, reached on July 31. CAT stock has gained 19.1% over the past three months, outperforming the broader Industrial Select Sector SPDR Fund’s (XLI) 6.5% rise over the same time frame.

In the longer term, CAT shares delivered 15.5% returns on a year-to-date (YTD) basis and 20.3% over the past 52 weeks, compared to XLI’s gains of 15.4% YTD and 17.7% over the past year.

To confirm the bullish trend, CAT has been trading above its 50-day moving average since early May. Also, the stock has been trading above its 200-day moving average since mid-June.

CAT stock has climbed significantly, buoyed by a strong demand in its Power Generation business, particularly fueled by artificial intelligence (AI) and data centers, lifting investors’ confidence. However, tariff-related pressures might continue to impact CAT’s performance at least in the near term.

Caterpillar’s rival Deere & Company (DE) has had a mixed ride - up 13% YTD, lagging behind CAT. But over the past 52 weeks, it’s quietly stolen the spotlight, delivering a stronger 26.6% gain, outpacing CAT’s performance in the longer race.

Wall Street analysts are moderately bullish on CAT’s prospects. The stock has a consensus “Moderate Buy” rating from the 22 analysts covering it, and the mean price target of $442.55 suggests a potential upside of 5.6% from current price levels.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.