Why Warren Buffett is Buying Lennar Stock, and How to Invest in Housing Like a Billionaire

During the latest Market on Close livestream, John Rowland, CMT, highlighted an under-the-radar shift happening in the U.S. housing market — and why homebuilder stocks and ETFs might be primed for a breakout.

With mortgage rates still elevated, single-family home affordability has hit a wall. But homebuilders aren’t sitting idle. Instead, they’re pivoting to a new model: “build-to-rent” communities.

The New Builder Playbook: Build-to-Rent

Here’s how it works:

Builders construct multifamily townhouses or rental-focused communities.

They fill them with tenants.

Then they sell the entire project to institutional buyers like BlackRock (BLK), Blackstone (BX), or KKR (KKR).

This business model is working, and it’s supporting the charts of publicly traded builders with a strong footprint in the multifamily space.

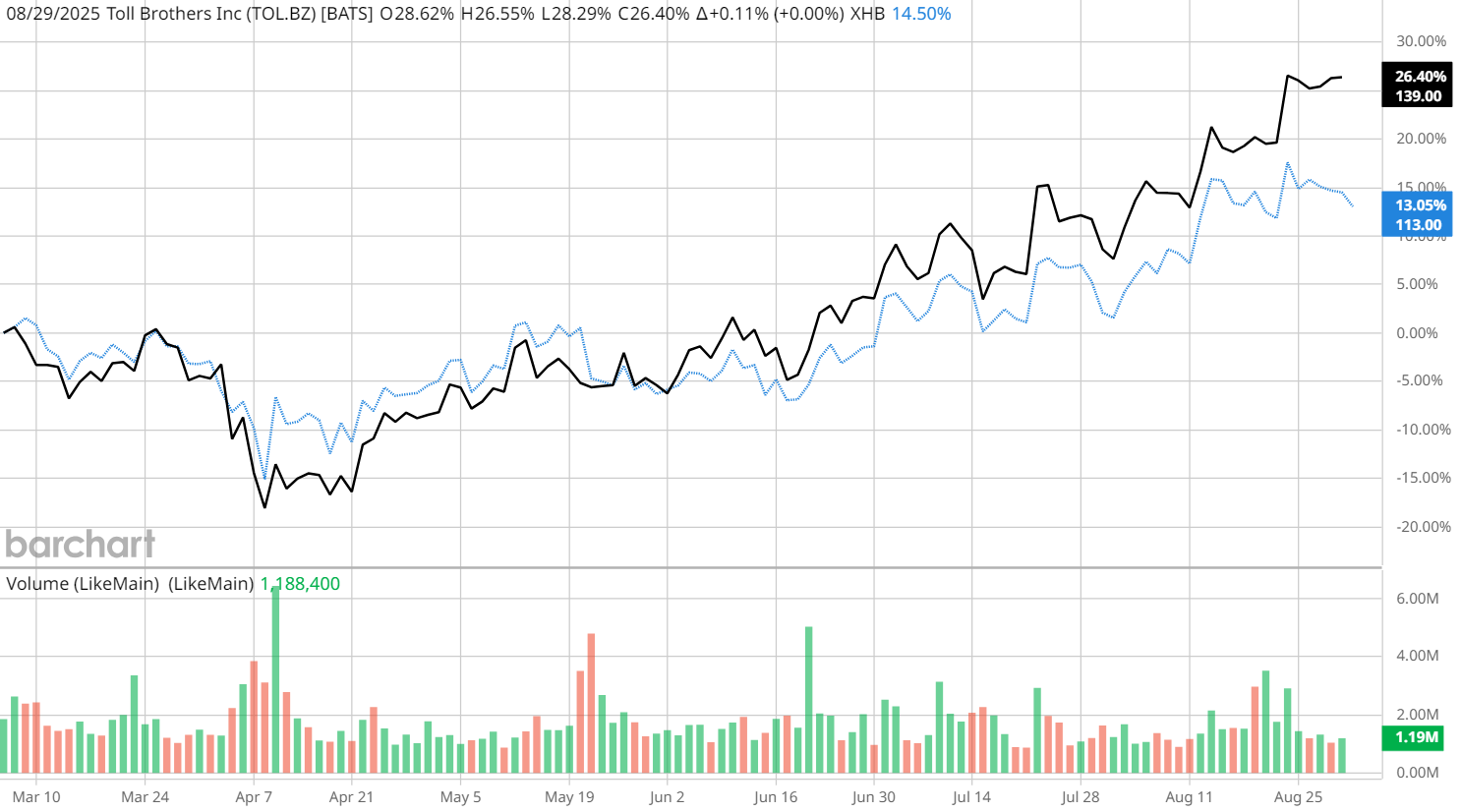

Toll Brothers (TOL), for example, has shown a strong, constructive chart pattern that correlates closely with the homebuilders ETF (XHB).

Buffett’s Signal: Berkshire Doubles Down

This isn’t just a technical story; it’s fundamental. Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) recently added to its stakes in D.R. Horton (DHI) and Lennar (LEN), two of the top multifamily builders. That move underscores the idea that even if single-family demand is cooling, the multifamily “build-to-rent” trend could power growth.

Technical Tailwinds

Rowland pointed out a looming “golden cross” setup, where the 50-day moving average crosses above the 200-day — often a bullish confirmation.

Combine that with relative strength in the sector despite broader market profit-taking, and it paints a compelling technical backdrop.

Why Homebuilders Matter to Investors

- Macro-sensitive sector: Housing reacts directly to mortgage rates and Fed policy.

- Diversification play: Homebuilders offer exposure outside of tech-heavy leadership.

- Early rotation indicator: Housing strength often signals renewed consumer and credit demand.

How to Track & Trade It with Barchart

- Top Holdings: Pull up ITB and XHB to check the largest holdings in the fund

- ETF Screener: Add filters like Sector = Real Estate, 50MA > 200MA, RSI between 40–60, and TrendSeeker = Buy.

- Related ETFs: Quickly scan homebuilder stocks (DHI, LEN, TOL, PHM, KBH) to explore their related ETFs for exposure to your top picks.

- Watchlists & Alerts: Save your homebuilder list and set email alerts for breakouts, RSI shifts, or price levels.

Bottom Line

The story for homebuilders now goes well beyond rate cuts; it’s about how homebuilders are innovating in a tough environment, and how investors can get ahead of a sector rotation.

Between Buffett’s bets, build-to-rent dynamics, and bullish technicals, housing deserves a closer look.

Watch this quick clip now to hear John Rowland’s full breakdown and see the charts in action:

On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.