Is AT&T Stock Outperforming the S&P 500?

Dallas, Texas-based AT&T Inc. (T) provides telecommunications and technology services worldwide. Valued at $209.4 billion by market cap, the company offers local and long-distance phone, wireless and data communications, Internet access and messaging, IP-based and satellite television, telecommunications equipment, and directory advertising and publishing services.

Companies worth $200 billion or more are generally described as “mega-cap stocks,” and T definitely fits that description, with its market cap exceeding this threshold, reflecting its substantial size, influence, and dominance in the telecom services industry. AT&T's global network and infrastructure investments provide dependable services, giving it a competitive edge. Their diverse offerings, ranging from mobile to entertainment, cater to various client needs, driving revenue streams and fostering customer loyalty. Strategic partnerships further enhance their growth and market position.

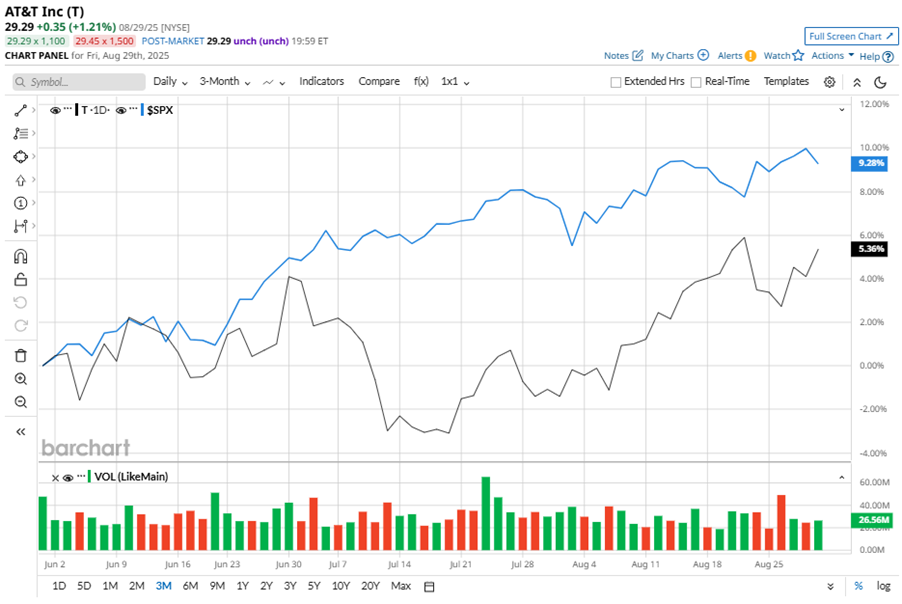

Despite its notable strength, T slipped 1.2% from its 52-week high of $29.65, achieved on Aug. 22. Over the past three months, T stock gained 7%, underperforming the S&P 500 Index’s ($SPX) 9.3% gains during the same time frame.

In the longer term, T shares rose 28.6% on a YTD basis and climbed 47.8% over the past 52 weeks, outperforming the SPX’s 9.8% surge in 2025 and 15.5% returns over the past year.

To confirm the bullish trend, T has been trading above its 50-day and 200-day moving averages over the past year, with slight fluctuations.

AT&T's outperformance is driven by its customer-centric model, strong postpaid wireless growth, and strategic investments in 5G and fiber infrastructure. The company is modernizing its network, expanding fiber broadband, and collaborating with tech giants like Microsoft Corporation (MSFT) and Alphabet Inc.’s (GOOGL) Google Cloud to enhance services and drive long-term growth.

On Jul. 23, T shares closed up more than 1% after reporting its Q2 results. Its adjusted EPS of $0.54 beat Wall Street expectations of $0.51. The company’s revenue was $30.8 billion, topping Wall Street forecasts of $30.5 billion. T expects full-year adjusted EPS in the range of $1.97 to $2.07.

In the competitive arena of telecom services, Verizon Communications Inc. (VZ) has lagged behind the stock, with a 10.6% uptick on a YTD basis and a 6.6% rise over the past 52 weeks.

Wall Street analysts are reasonably bullish on T’s prospects. The stock has a consensus “Moderate Buy” rating from the 29 analysts covering it, and the mean price target of $30.43 suggests a potential upside of 3.9% from current price levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.