Supermicro Stock Drops 29% in a Month: Is SMCI a Buy, Sell, or Hold?

/Super%20Micro%20Computer%20Inc%20logo%20on%20building-by%20Poetra_RH%20via%20Shutterstock.jpg)

Super Micro Computer (SMCI), or Supermicro, has had a rough stretch in recent weeks. SMCI stock dropped more than 29% over the past month, with much of that decline sparked by its latest fourth-quarter earnings report. While the company has been one of the top beneficiaries of the artificial intelligence (AI) boom, its earnings and guidance have fallen short of expectations, and growth has slowed significantly.

Supermicro is known for its high-performance servers and storage systems optimized for AI-specific workloads. Its solid positioning in the AI hardware space drove extraordinary growth in fiscal 2024, with sales surging at a breakneck pace. But in the most recent quarter of its fiscal 2025, the story shifted.

For instance, its Q4 revenue came in at $5.8 billion, up 7.4% from the prior year. That figure represented a steep deceleration compared with earlier quarters, where sales were up 19.5% in Q3, 54.9% in Q2, and 180.1% in Q1.

The company’s margins have also come under pressure. Its adjusted gross margin dropped 70 basis points to 9.6%. Adjusted earnings per share (EPS) declined compared to the same period last year, in part due to tariffs.

Management highlighted hurdles, including limited access to capital, which slowed production scaling, and shifting product specifications from major customers that impacted Q4 results. Longer purchase cycles, a side effect of rapid advances in AI technology, added yet another challenge.

Are Supermicro’s Problems Temporary?

Supermicro’s recent earnings and guidance fell short of expectations. However, SMCI’s management remains optimistic, signaling that the recent challenges are temporary and the long-term growth story remains intact.

The company has reassured investors that earlier capital constraints are no longer a concern. Meanwhile, large customer orders that were delayed are now expected to be recognized in the September and December quarters. The company’s customer base is also expanding, with the number of large-scale rack clients doubling from two in fiscal 2024 to four in fiscal 2025. Management expects this momentum to continue, with additional customers likely to be acquired in fiscal 2026. This trend highlights both rising demand and strong momentum in its customer pipeline.

Furthermore, to address margin concerns, Supermicro is focusing on higher-margin revenue streams, which are expected to contribute to improved profitability over time. Its strategic focus on the enterprise, internet of things (IoT), and telecom markets positions it well for long-term growth. In recent quarters, Supermicro has invested heavily in tailoring its solutions for enterprise clients, rolling out advanced server and storage systems optimized for hybrid cloud, AI, and edge computing. The launch of an enhanced enterprise service program further strengthens its offering by providing comprehensive, round-the-clock support for high-density, performance-driven data centers.

Momentum is also building in its IoT portfolio, where demand is accelerating across various industries, including healthcare, manufacturing, telecom, and smart cities. Supermicro’s embedded systems and edge servers are being adopted for a wide range of AI edge applications, and its partnerships with industry leaders are designed to fast-track innovation in both AI-at-the-edge and telecom solutions. By expanding into these higher-margin areas, the company is diversifying its revenue streams while setting the stage for sustainable profitability.

Notably, Supermicro’s global manufacturing footprint enhances its supply chain resilience and margins. With major campuses in the U.S., Taiwan, Malaysia, and the Netherlands, the company is likely to deliver complete systems and data center solutions efficiently while mitigating tariff exposure. This geographic diversity enables it to serve customers worldwide, adapt quickly to shifting regional demands, and maintain a flexible supply chain.

Is Supermicro Stock a Buy, Sell, or Hold?

Supermicro is poised to gain from the strong demand for its AI-optimized servers and storage systems. To meet the surging demand, Supermicro has been rapidly expanding both its product lineup and its manufacturing footprint. Its Datacenter Building Block Solutions (DCBBS), designed to accelerate the building of data centers, could see solid demand. Moreover, the company is doubling down on cooling technologies, including air-cooled and direct liquid cooling systems, as AI workloads grow more complex and energy-intensive. This positions Supermicro as a provider of high-performance computing solutions and a partner for greener, more sustainable infrastructure.

Looking ahead, SMCI is projecting revenue of $33 billion for fiscal 2026, representing a 50% year-over-year increase. That momentum is expected to come from its expanding base of enterprise customers, innovations in product design, and greater adoption of its full-stack data center solutions.

However, Supermicro operates in a highly competitive market, with established players such as Dell (DELL) likely to gain share in the AI-optimized server market. That pressure could put its margins under strain, even as demand continues to rise.

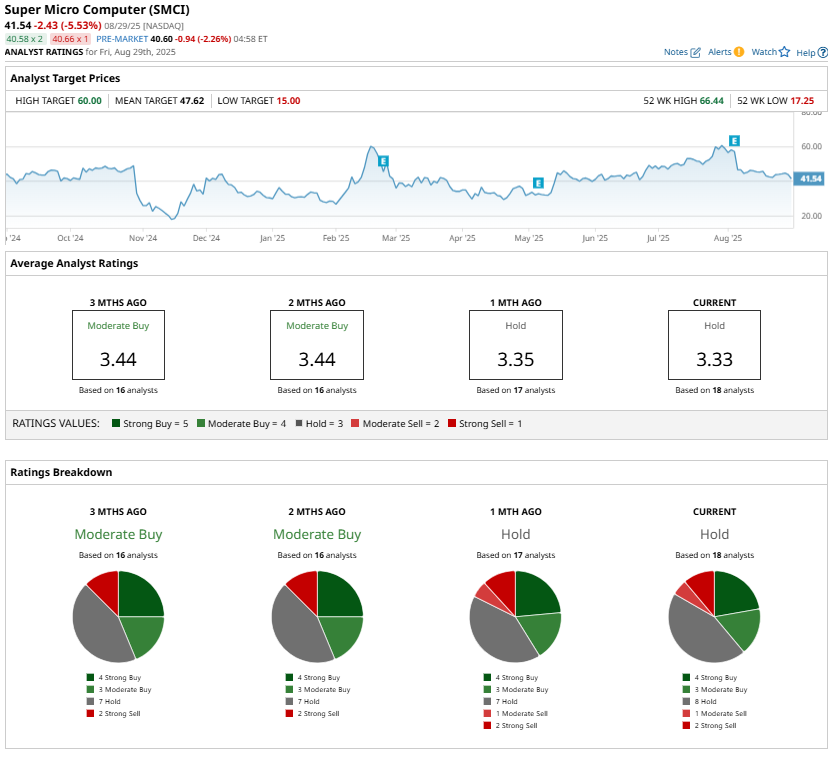

Thus, for now, Wall Street seems cautious. SMCI stock carries a consensus “Hold” rating.

In summary, Supermicro’s recent stock decline reflects near-term challenges. However, its strong positioning in the AI server market, expanding customer base, and focus on higher-margin opportunities provide a compelling long-term growth narrative. While SMCI may face volatility in the short run, its fundamentals suggest potential for recovery. However, one should remain sidelined until the company shows clear signs of sustained momentum.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.