Insiders Bought the Selloff in Eli Lilly. Should You Buy LLY Stock, Too?

/Eli%20Lilly%20and%20Co_%20by%20Sergio%20Photone%20via%20Shutterstock.jpg)

In a recent Market on Close livestream, John Rowland, CMT, broke down one of the most talked-about developments in Eli Lilly (LLY): a wave of insider buying after the company’s worst single-day loss in 25 years.

What Happened?

In early August, Eli Lilly (LLY) shares suffered a sharp decline, erasing billions in market cap in just one session after poorly received drug data that was released alongside earnings. With the company valued at roughly $700 billion, it was the kind of move that rattled even seasoned traders.

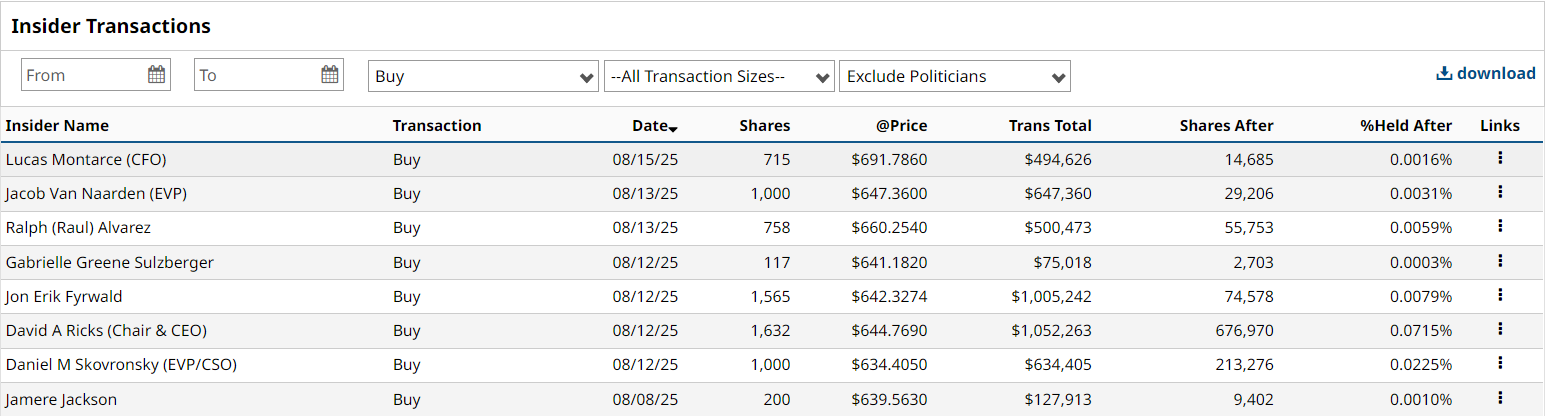

But just days later, filings showed that insiders — including the Chair & CEO, CFO, and EVP — collectively purchased about $4.5 million worth of LLY shares at prices around $640.

That begs the question: Does insider buying mean it’s time to get bullish?

The Bullish Case

- Confidence Signal: As Peter Lynch famously noted, there are many reasons insiders sell, but usually only one reason they buy — they believe the stock will go higher.

- Pipeline Strength: Eli Lilly’s blockbuster drugs like Mounjaro and Wegovy (diabetes/weight loss) and its Alzheimer’s program are expected to drive strong long-term revenue.

- Smart Money Entry: Buying after a major decline can indicate insiders see the pullback as temporary, with shares undervalued relative to growth prospects.

The Bearish Case

- Relative Size: $4.5 million sounds large, but in a $700B company it’s a small stake, and more symbolic than transformational.

- Not Always Predictive: As Rowland noted, sometimes insider buys are more about optics or personal conviction than clear foresight.

- Valuation Risks: With Lilly already trading at a premium, the stock’s high expectations leave little room for error if trial results or regulatory outcomes disappoint.

How to Track Insider Activity Yourself

The best part is, you don’t need to wait for headlines. Barchart’s Insider Trading Activity page lets you:

- See both buys and sells from insiders and politicians.

- Filter by company, trade type, or trade size.

- Cross-reference insider buying with Barchart’s Opinion Ratings, TrendSeeker® signals, and technical indicators.

- Spot patterns where insider conviction aligns with bullish technicals or discounted valuations.

For Eli Lilly, you could look at the Insider Activity tool to see the exact dates, share counts, and prices of these recent purchases — helping you weigh whether they align with your own trade thesis.

Bottom Line

Insider buying isn’t a guarantee of gains — but it’s a powerful confidence indicator worth watching, especially when it comes from the C-suite. With Eli Lilly sitting at the intersection of biotech innovation, massive revenue potential, and premium valuation risk, it’s a name every trader should keep on their radar.

Watch the clip now to hear John Rowland’s full take, and explore Barchart’s Insider Trading Activity to spot similar opportunities before the headlines hit.

Stream the full episode of Market on Close and sign up for notifications to join us live.

On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.