Is Celsius Stock a Buy, Sell, or Hold for September 2025?

Celsius Holdings (CELH) is a global beverage company known for its premium lifestyle energy drink, CELSIUS, a zero-sugar alternative to traditional energy drinks. The brand is known for promoting an active lifestyle with its fruit-flavored, functional beverages designed to support an energetic lifestyle. Celsius has rapidly expanded its portfolio to include offerings like Fizz-Free and On-The-Go powders, catering to diverse consumer preferences.

Founded in 2004, the company was formerly known as Vector Ventures until 2007 and has its headquarters located in Boca Raton, Florida.

Celsius Stock Rallies

CELH stock has shown strong performance recently, reflecting robust investor confidence. Over the past five days, the stock gained approximately 1%, and over one month, it surged around 35%. Its six-month return stands impressively at about 135.8%, while year-to-date (YTD) growth is roughly 130%. The 52-week performance reveals a healthy gain of around 59.3%, showcasing sustained momentum.

In comparison, the Nasdaq Composite Index ($NASX) has been relatively subdued with a five-day decline of about 2.6%, a slight one-month gain near 2%, a six-month jump of around 11.8%, and a YTD increase of approximately 9.1%. Celsius's significant outperformance versus its benchmark highlights its strong growth potential and investor appeal amid broader market volatility.

Celsius’s Strong Q2 Results

Celsius Holdings delivered impressive results in Q2 2025, surpassing expectations with revenue climbing to $739.3 million, marking an 84% increase from the previous year. Adjusted diluted EPS rose to $0.47, a 68% improvement over last year’s $0.28, also beating analyst forecasts. This growth was largely fueled by the Alani Nu brand, which generated $301.2 million in revenue, alongside a 9% increase in sales from the Celsius brand.

The company’s gross margin stood at 51.5%, slightly lower than the 52% recorded in Q2 2024, reflecting Alani Nu’s lower margin mix. Adjusted EBITDA more than doubled, reaching $210.3 million with a margin of 28.4%, demonstrating effective operational scale. Net income rose by 25% to $99.9 million. Healthy free cash flow was maintained as Celsius continued investing in marketing and expansion efforts. North American revenue surged 87%, while international sales grew 27% compared to the prior year.

Looking ahead, Celsius reaffirmed its optimistic outlook, anticipating continued momentum from both the Celsius and Alani Nu brands. The company expects to sustain its above-industry revenue growth and further increase market share, targeting solid profitability gains in upcoming quarters.

Pepsi Increases Stake

PepsiCo (PEP) is boosting its stake in Celsius as part of a strengthened strategic partnership, leading to a surge in CELH stock. PepsiCo, Celsius’ primary U.S. distributor, recently purchased $585 million in newly issued convertible preferred shares, securing an 11% ownership in the company. This deal also includes PepsiCo nominating an additional director to Celsius’ board, deepening their collaboration.

As part of the agreement, Celsius has acquired PepsiCo’s Rockstar Energy brand in the U.S. and Canada, while Celsius’ Alani Nu brand will enter PepsiCo’s distribution network across these markets. This expanded access is expected to enhance retail distribution, including restaurants and emerging sales channels.

PepsiCo first invested $550 million in Celsius in 2022, integrating its drinks into PepsiCo’s extensive distribution system. This new deal designates Celsius as PepsiCo’s strategic energy partner in the U.S. Celsius CEO John Fieldly emphasized their goal to broaden consumer reach with a comprehensive energy portfolio.

Celsius’s healthier, sugar-free drinks and social media marketing have supported rapid market share gains against rivals like Red Bull and Monster Beverage (MNST). Despite some inventory optimization by PepsiCo causing a dip in sales in late 2024, retail demand remains strong. The Alani Nu brand’s impressive 129% year-over-year (YoY) retail sales growth highlights its appeal to younger, diverse audiences, while Celsius’ core brand rebounded with 9% revenue growth in the latest quarter.

Should You Buy CELH?

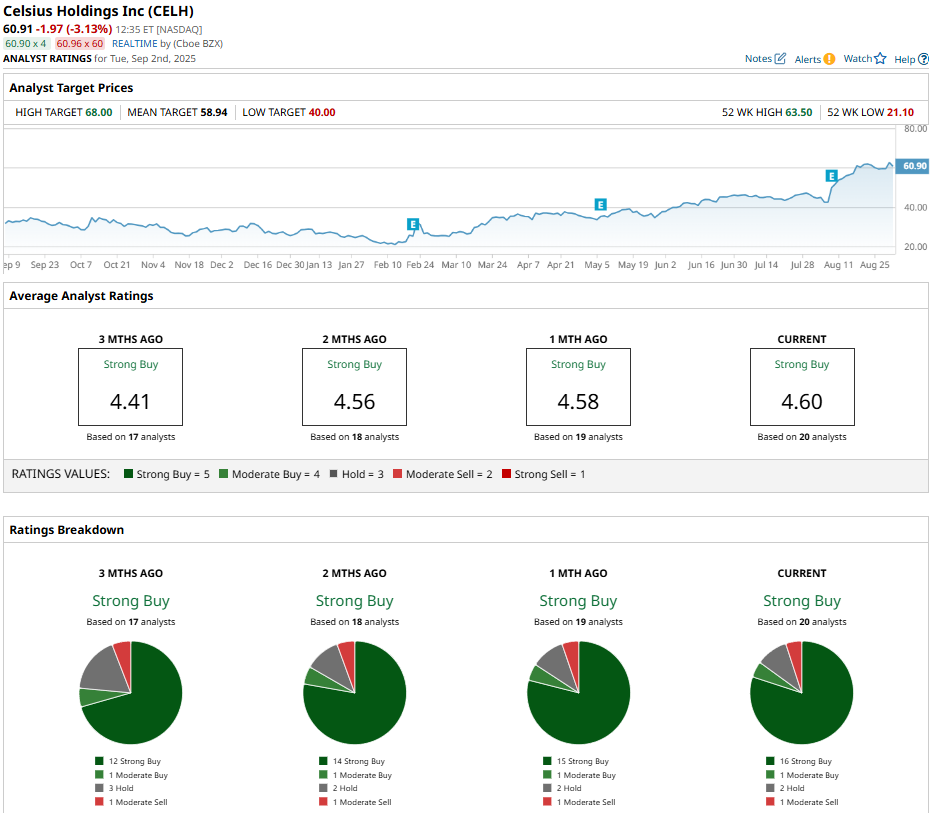

CELH stock has been given a consensus “Strong Buy” rating from analysts, with a mean price target of $58.94, which is slightly below the market rate. The stock has been analyzed by 20 analysts, who have issued 16 “Strong Buy” ratings, one “Moderate Buy” rating, two “Hold” ratings, and one “Moderate Sell” rating.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.