Down 30% in 2025, Should You Buy the Dip in Chipotle Stock?

/Chipotle%20Mexican%20Grill%20logo%20on%20building%20by-%20John%20Hanson%20Pye%20via%20Shutterstock.jpg)

Fast-casual restaurant giant Chipotle Mexican Grill (CMG) has long been a success story, with customers flocking to its restaurants year after year, with the COVID-19 pandemic being a rare exception. In fact, the chain had posted consecutive year-over-year (YOY) comparable sales gains every quarter since mid-2020. But that streak came to a halt in the first quarter of fiscal 2025, and things took a further hit in the second quarter.

To be fair, Chipotle isn’t the only restaurant stock losing steam. Several top fast-food names have struggled in late 2024 and into 2025, as shaky consumer confidence and economic headwinds have weighed on discretionary spending. For Chipotle, this has translated into a drop in same-store sales in Q2 along with a decrease in foot traffic for the second consecutive quarter. Moreover, the company also trimmed its full-year same-store sales outlook.

Investors were clearly unhappy with the company’s latest results as the stock crashed nearly 13.3% on July 24. With shares now down 30% in the year to date, would it be wise to buy CMG stock on the dip?

About Chipotle Stock

Valued at $56.5 billion by market capitalization, California-based Chipotle operates more than 3,800 restaurants across the U.S. and several international markets, including Canada, the United Kingdom, France, and the UAE.

After soaring 196% over the past decade, Chipotle’s stock has hit a rough patch. The burrito chain has struggled to keep up with the broader market lately, shedding nearly 25% over the past year while the S&P 500 Index ($SPX) has climbed 13%. The slide has been even steeper in 2025. Shares are down 30% year-to-date (YTD), compared to an 8.9% gain for the index. It’s a sharp reversal for a longtime market favorite, as slowing traffic and softer demand weigh on investor sentiment.

On the surface, Chipotle’s current valuation might still look pricey, trading at 34.9 times forward earnings. But zoom out a bit, and it’s clear the stock has come down meaningfully from its historical premium. Compared to its five-year average multiple of 60.82x, CMG is now trading at a notable discount to its own past.

Inside Chipotle’s Q2 Earnings Report

Chipotle’s fiscal 2025 second-quarter results were a mixed bag, and investors weren’t impressed. While the company reported $3.06 billion in revenue, marking a 3% increase YOY thanks to new restaurant openings, it still missed Wall Street’s $3.11 billion estimate. During the quarter, Chipotle opened 61 new company-owned locations, 47 of which featured a Chipotlane, continuing its focus on digital and drive-thru convenience.

But top-line growth wasn’t enough to mask the cracks showing in its core performance. Comparable restaurant sales, a key metric that tracks sales at company-owned locations open for at least 13 full months, fell 4% in Q2. That’s a steeper decline than the 0.4% dip in the prior quarter and a sharp reversal from the 11% growth posted during the same period last year. The drop was largely fueled by a 4.9% decline in transactions, pointing to a clear pullback in customer traffic.

Profitability also took a hit. Adjusted EPS came in at $0.33, down 2.9% from the year-ago quarter, though it still managed to beat analyst expectations by a modest 3.1%. Operating margin shrank to 18.2%, down 1.5 percentage points, as lower traffic and rising ingredient costs weighed on results, only partially offset by recent menu price hikes.

Adding to the disappointment, the burrito chain slashed its full-year outlook, as spending patterns remain unpredictable amid macroeconomic volatility. For fiscal 2025, the company now expects flat same-store sales growth, down from its earlier forecast of a low-single-digit increase. However, it still plans to open between 315 and 345 new restaurants this year, with more than 80% expected to include a Chipotlane.

What Do Analysts Think About Chipotle Stock?

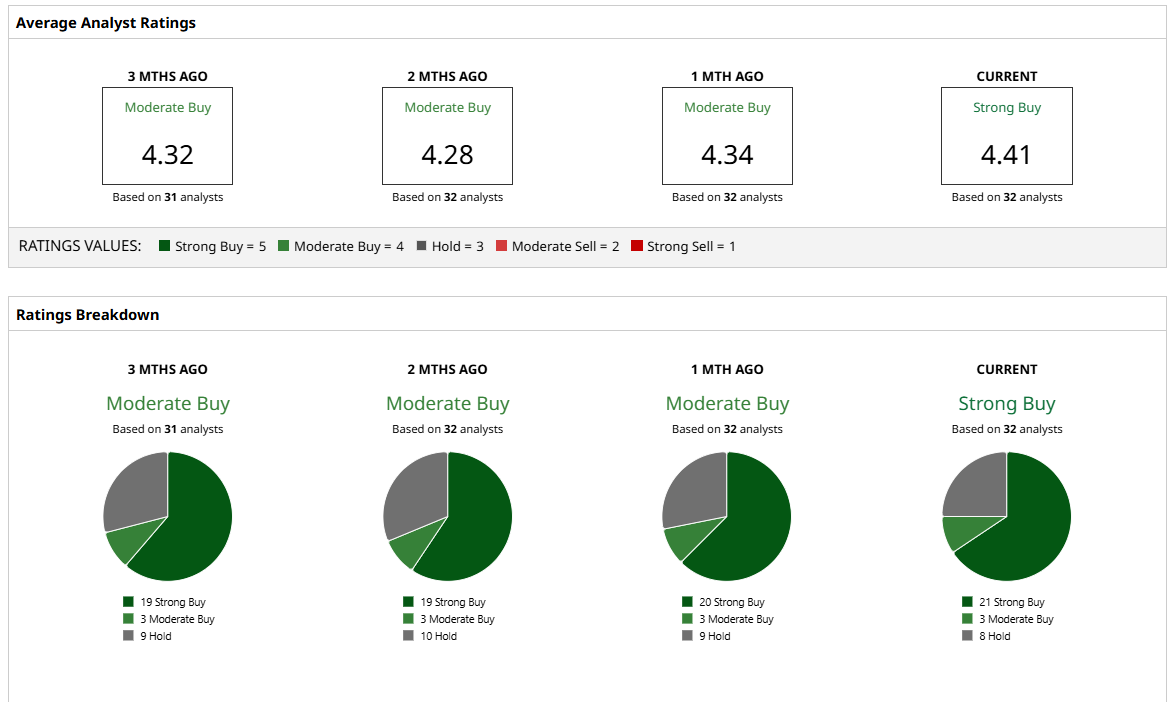

Despite a rough second quarter, Wall Street analysts are still backing Chipotle’s long-term story with a consensus “Strong Buy” rating. Out of 32 analysts covering the name, a majority of 21 analysts are backing it with a “Strong Buy,” three advocate “Moderate Buy,” while the remaining eight recommend a “Hold.”

CMG’s average analyst price target of $59.03 suggests 43% potential upside from current levels, while the Street-high target of $70 implies that the stock can rally as much as 70% from here.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.