This Option Trade Lets You Play the Hangover in Constellation Brands Stock with 4-to-1 Odds of Success

It’s the stock with the weird ticker symbol, since the company name is Constellation Brands (STZ). “STZ” is short for stars, I assume. Just what you’d expect for a global leader in alcoholic products, right?

While you’re working on figuring that one out, let’s move on to discuss what just happened to STZ stock.

Because 25 years after the former Canandaigua Wine Company grew its business to well beyond its traditional wine base and changed its trading ticker, it’s fair to say that potential confusion is the least of its concerns.

STZ’s statement Tuesday, in which it lowered its sales forecast and profit projections, confirmed the market’s concerns about the spirits business. Consumers are making fewer trips to the store, and are spending fewer dollars per trip when they do.

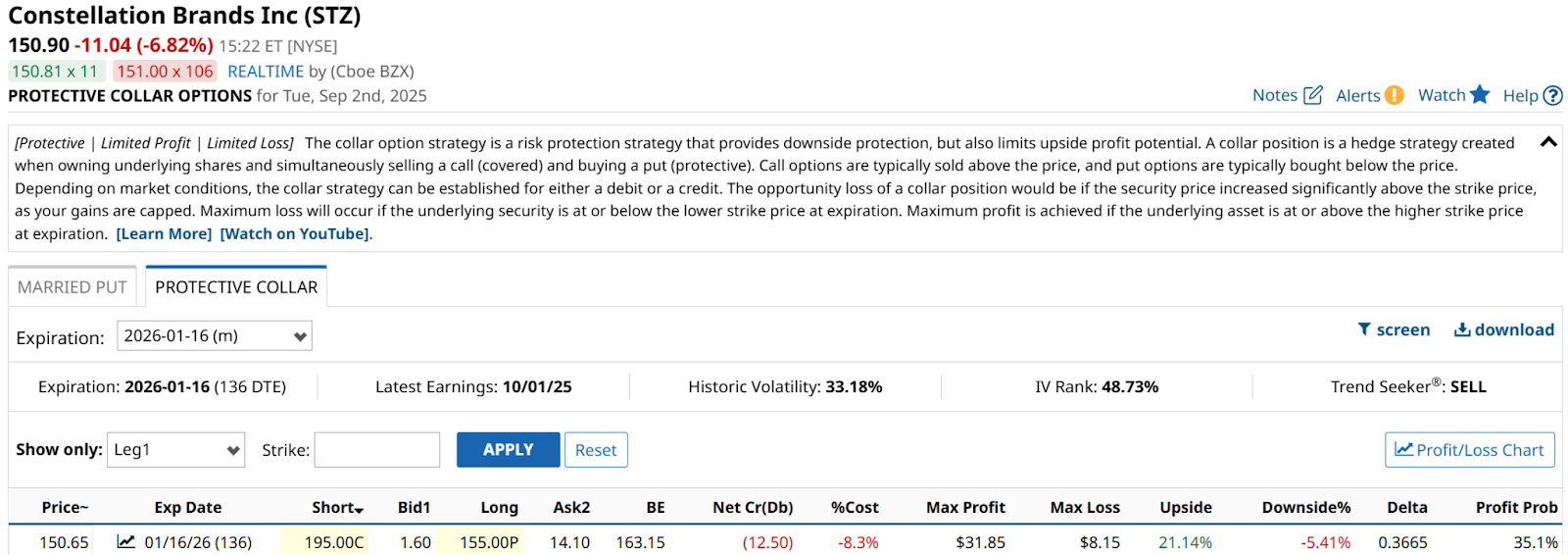

The Numbers Behind the Thirst

Constellation Brands is the owner of popular Corona and Modelo, and it certainly has the advantage of leadership within its industry. And it sells for just 12x trailing earnings.

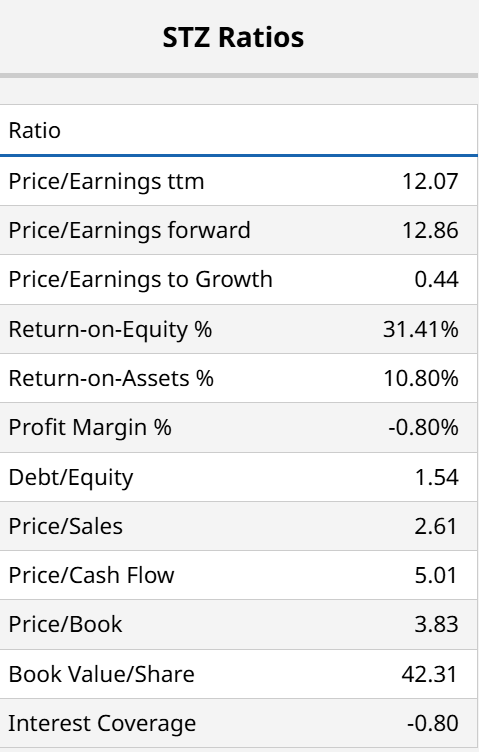

In fact, there’s quite a mixed bag of financial ratios here, including low P/E, but also low profit margin. And a price-sales ratio that could be at least a tad high for a company like this.

You also don’t tend to see this type of earnings, revenue, and dividend growth, paired with that type of serial stock price decline.

Because buying the dip is the new American investing pastime, let’s look at the daily chart and potential option plays.

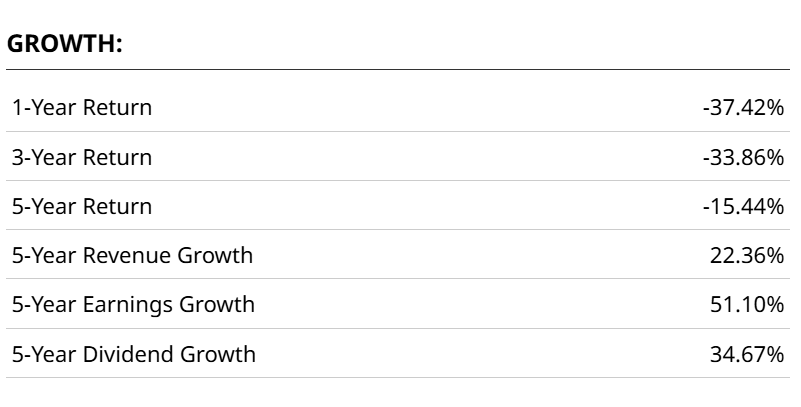

OK, next question please (that chart looks terrible to me). Maybe the weekly will show that the daily is just punch-drunk from Tuesday’s price plunge.

No such luck. Here’s the weekly below. This stock has had sellers trumping buyers for well over a year now. And since that breakdown below key support way up at around $215 a share, it has not had more than a whiff of a rally. The charts do a good job of sniffing out trouble, particularly when a falling stock is getting riskier, not turning into the much hoped for “bottom.”

The Hangover

I’d call that weekly chart a “hangover.” First, because it keeps hanging over itself lower. And, second, because I always like a good dad joke. So with nothing in the charts but waiting for a shot out of left field, so to speak, via an improvement in the sales trend or a superior quarterly report (due in about one month), the only way to even consider STZ that I can rationalize would be an option collar. So let’s take a look.

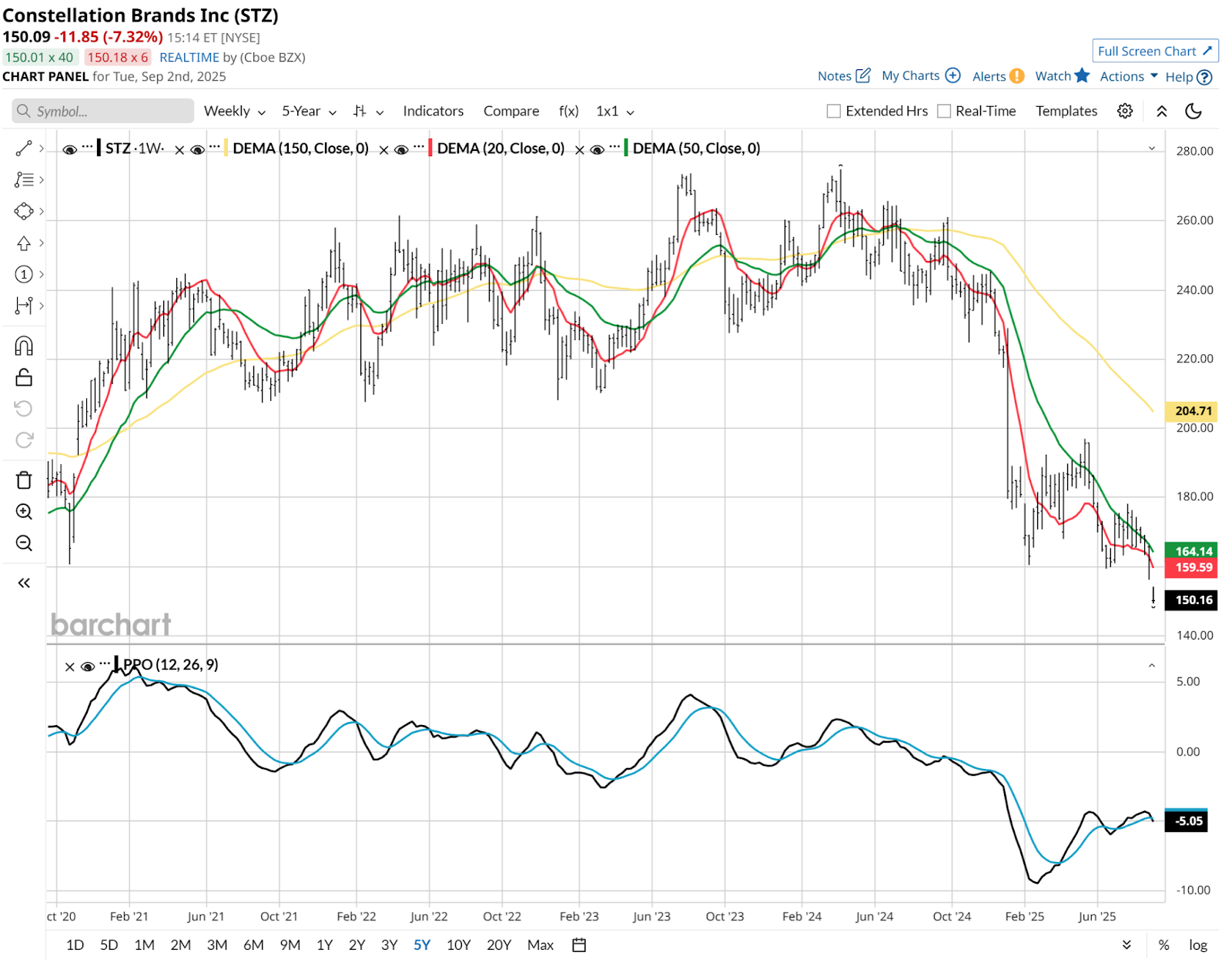

In this case, with the stock in bad shape recently, the collar I chose to highlight is one that counts on the stock really lifting at some point soon. More importantly, I’m giving it the time to do so.

This one goes out to Jan. 16, 2026. That includes the next two quarterly earnings reports, one in early October, and the next in early January. To get all of that time, I’m willing to let it move up 8%, essentially to where it traded last Friday, to cover my cost of the puts at $155 (above the current stock price) less what’s received for the covered call ($195 strike price).

The key to this is skipping ahead, in my mind, to where the stock will shake this all off.

If it can, this collar has 21% upside from here versus only 5% downside. That downside is less than the cost of the options, you’ll notice. That’s because the puts are struck at $155, higher than STZ’s $151 price as I wrote this on Tuesday afternoon.

There’s Only 1 Way to Play STZ Stock Here

Four-to-one upside to downside always gets my attention. Even for a stock this down on its luck. However, the beauty of the above option collar is that it lets investors ride up any “sobering up” Constellation does without taking on the risk of more mornings spent stumbling home.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.