Dear FUBO Stock Fans, Mark Your Calendars for September 2

Sports-first live TV streaming platform Fubo (FUBO) debuts its new sports bundle today at $55.99 a month. The bundle comes with a range of over 20 live sports and news-focused channels, such as ESPN and Fox Sports, along with local stations owned by ABC, CBS, and Fox. Limited to “select markets” with plans for expanding into the future, the service will also include all the content in ESPN’s “Unlimited” $29.99 package and popular Fubo features like multiview, a “catch up to live” option that shows highlights of a game you’ve joined late, and unlimited DVR.

About Fubo

Founded in 2015, Fubo is a sports-first live TV streaming platform, offering live sports, entertainment, and news channels across the U.S., Canada, Spain, and France (via Molotov). Fubo’s primary revenue comes from its tiered subscription packages, catering to an audience that is focused on sports. Its tech-forward approach, marked by interactive features, original content, and performance optimization, sets it apart in a competitive market.

Valued at a market cap of $1.2 billion, the FUBO stock has hit a home run this year with a rally of 200% on a year-to-date (YTD) basis. The primary catalyst for this stark uptick in the company's stock has been the announcement of its merger with Disney's (DIS) Hulu+ Live TV, entailing a windfall payment of $200 million for the company. Set to close by the end of this year or the first quarter of 2026, Fubo will continue to trade under the FUBO ticker.

So, where does it leave Fubo as an investment? Let's take a closer look.

Inconsistent Financials With Valuation Comfort

Fubo's financials don't inspire that much confidence, as the company is yet to be consistently profitable, with not much growth seen in revenues as well.

In fact, the results for the most recent quarter saw Fubo reporting a decline in revenues. Fubo's revenues for Q2 2025 stood at $380 million, which denoted a yearly fall of 2.8%, as the core North American segment saw a year-over-year (YOY) drop of 3%, along with a 6.5% decline in the number of subscribers to 1.356 million in the same period. Subscribers count for the Rest of the World segment saw an even sharper YOY reduction of 12.5% to 349,000.

However, encouragingly, losses narrowed to $0.02 per share from $0.08 per share in the year-ago period, while also coming in narrower than the consensus estimate of a loss of $0.03 per share. Notably, this also marked the ninth consecutive quarter of the company's bottom line exceeding Street expectations.

The company also turned net cash flow positive in the first six months of 2025 to report net cash from operating activities of $126.8 million, compared to an outflow of $99.5 million in the prior year. Overall, the company closed the June 2025 quarter with a cash balance of $283.6 million, which was higher than its short-term debt levels of $156.5 million.

Further, despite the searing rally seen in the stock this year, it remains in the undervalued territory compared to its industry peers. Its forward price-to-earnings (P/E) and price-to-sales (P/S) of 12.30 and 0.78 are both lower than the sector medians of 18.90 and 1.29, respectively.

Still a Winner

Notwithstanding its modest performance on certain financial metrics, Fubo’s trajectory has shown encouraging signs, aided in large part by the earlier agreement with Disney. While its latest results still indicate room for improvement, the company appears to be moving in a favorable direction. Investor sentiment has been buoyed by expectations that the planned integration with Disney’s Hulu + Live TV could transform Fubo’s market position and deliver meaningful shareholder value over time.

Despite the pending merger, management has continued to advance its portfolio of offerings. Alongside the introduction of Fubo Sports, it has rolled out a pay-per-view option enabling both subscribers and non-subscribers to purchase access to individual live events.

Central to Fubo’s growth agenda is its super-aggregation model, which is designed to consolidate multiple forms of content—ranging from live television and on-demand programming to free ad-supported channels, premium subscriptions, and anticipated transactional options—into a single user interface. This integrated approach contrasts with the aggregation strategies of platforms such as Roku (ROKU), Amazon (AMZN), and Alphabet’s (GOOG) (GOOGL) YouTube, where the focus lies on reselling subscriptions to external services like HBO Max, Discovery+, and Paramount+ within their own ecosystems.

The super-aggregation framework is reinforced by a tiered pricing structure offering different bundles of content. A free, ad-supported tier is also set to launch later in the year, with the intention of retaining users during the quieter months between major sports seasons. By giving audiences reasons to remain engaged even when they opt out of paid plans, Fubo aims to reduce churn and sustain platform loyalty.

Supporting this entire ecosystem is a growing suite of artificial intelligence capabilities intended to make content discovery more intuitive. Among the innovations are Instant Headlines, which deliver quick, AI-generated summaries of sports news, and personalized game alerts that keep fans informed of developments relevant to their preferences.

The company has also developed a Playlist Service that applies AI to curate and organize content stored on users’ DVRs, enabling them to view highlights from live sports without sifting through full broadcasts. Another widely adopted feature, the Teams Channel, automatically compiles themed playlists containing recaps, previews, expert commentary, interviews, and injury updates tailored to the viewer’s chosen teams.

Analyst Opinion

However, although Fubo is making strides in terms of innovation in its offerings, it should make efforts to stem its decline in subscriber count. Not only does this lead to a fall in revenues, but it also results in lower bargaining power for the company when negotiating content licensing deals, as major media companies and sports leagues prefer to license their content to platforms that have a consistently increasing audience base.

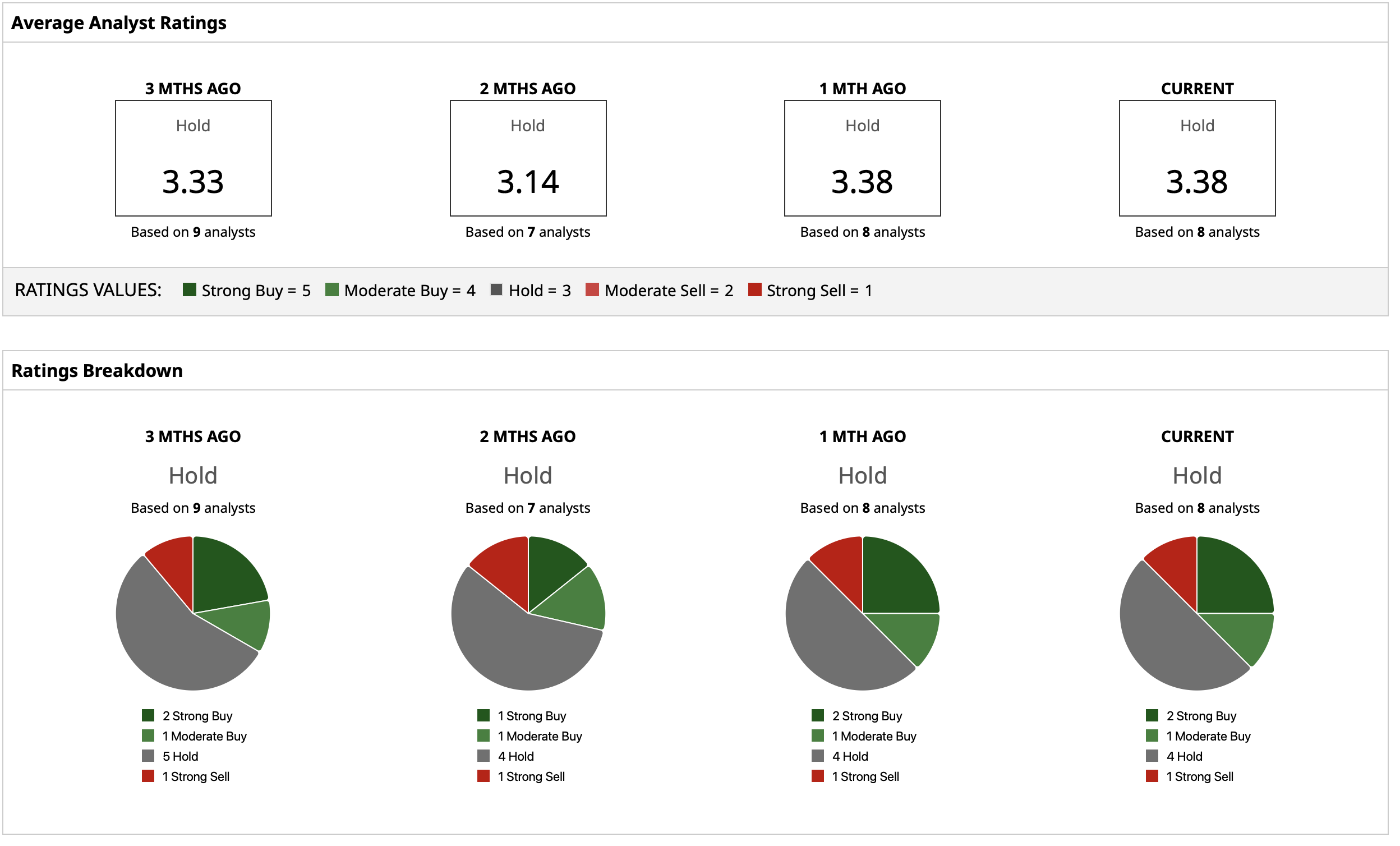

Thus, amid conflicting signals, analysts have attributed a rating of “Hold” for the stock, with a mean target price of $5.08, which indicates an upside potential of about 34% from current levels. Out of eight analysts covering this stock, two have a “Strong Buy” rating, one has a “Moderate Buy” rating, four have a “Hold” rating, and one has a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.