Is Duke Energy Stock Outperforming the Dow?

With a market cap of $94.8 billion, Duke Energy Corporation (DUK) is one of the largest energy holding companies in the United States. The company operates through two main segments: Electric Utilities and Infrastructure, serving about 8.6 million customers, and Gas Utilities and Infrastructure, providing natural gas to roughly 1.7 million customers.

Companies valued at more than $10 billion are generally considered “large-cap” stocks, and Duke Energy fits this criterion perfectly. With a diverse energy portfolio spanning coal, natural gas, oil, hydroelectric, nuclear, and renewables, Duke Energy also invests in pipeline projects, renewable natural gas, and storage facilities.

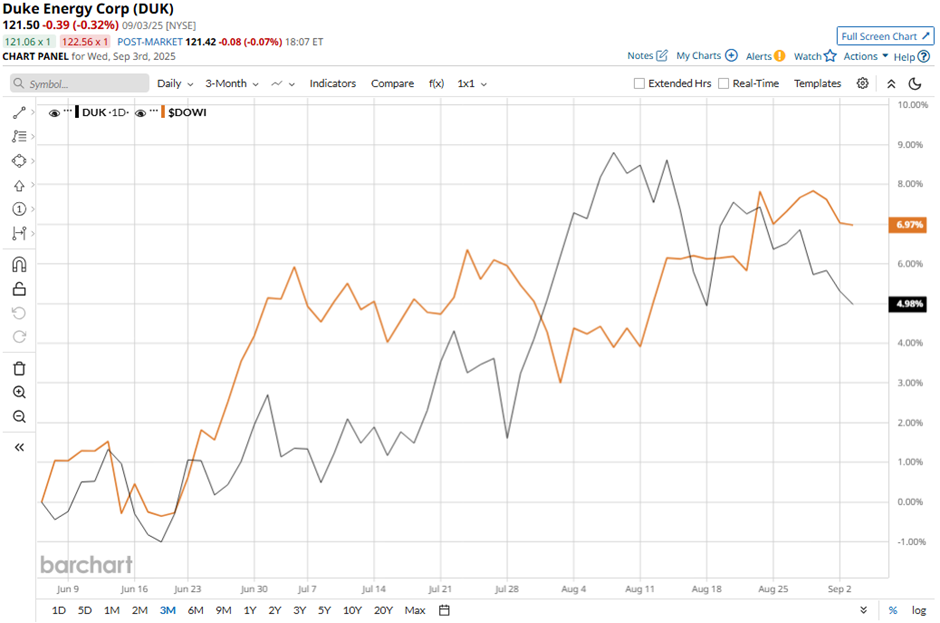

Shares of the Charlotte, North Carolina-based company have declined nearly 5% from its 52-week high of $127.85. Over the past three months, Duke Energy's shares have risen 4.1%, underperforming the broader Dow Jones Industrials Average's ($DOWI) 6.5% gain during the same period.

Longer term, shares of the electric utility have returned 4.9% over the past 52 weeks, lagging behind DOWI’s 10.6% surge over the same time frame. However, the stock is up 12.8% on a YTD basis, outperforming DOWI's 6.4% rise.

DUK stock has been in a bullish trend, consistently trading above its 200-day moving average since last year.

Despite Duke Energy’s better-than-expected Q2 2025 EPS of $1.25 and revenues of $7.5 billion, shares fell marginally on Aug. 5. Total operating expenses increased 4% year-over-year to $5.7 billion, while interest expenses climbed to $897 million, and long-term debt rose to $78.9 billion from $76.34 billion at year-end 2024. Additionally, total electric sales volumes declined 1.3% year-over-year, signaling weaker demand despite customer growth.

Additionally, DUK stock has performed weaker than its rival, American Electric Power Company, Inc. (AEP). AEP stock has soared 19.3% YTD and 8.3% over the past 52 weeks.

Despite Duke Energy’s outperformance relative to the Dow over the past year, analysts remain cautiously optimistic about its prospects. The stock has a consensus rating of “Moderate Buy” from 21 analysts in coverage, and the mean price target of $132.60 is a premium of 9.1% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.