Is Starbucks Stock Underperforming the Nasdaq?

/Starbucks%20Corp_%20logo%20by-%20eyewave%20via%20iStock.jpg)

Starbucks Corporation (SBUX) has grown into a global icon of the coffeehouse industry, serving millions globally via its flagship Starbucks, Teavana, Ethos, and Starbucks Reserve brands. The company’s world headquarters is in Seattle, Washington. Starbucks commands a substantial market cap of $99.2 billion.

Companies with a market cap of $10 billion or more are typically classified as “large-cap stocks,” a category that represents established businesses with significant financial strength and global influence. Starbucks comfortably falls into this category, affirming its scale, stability, and broad investor confidence. This status underscores Starbucks’ entrenched leadership in the global coffeehouse industry, where its iconic brand, expansive global footprint, and innovative retail and digital strategies solidify its dominance and ongoing growth potential.

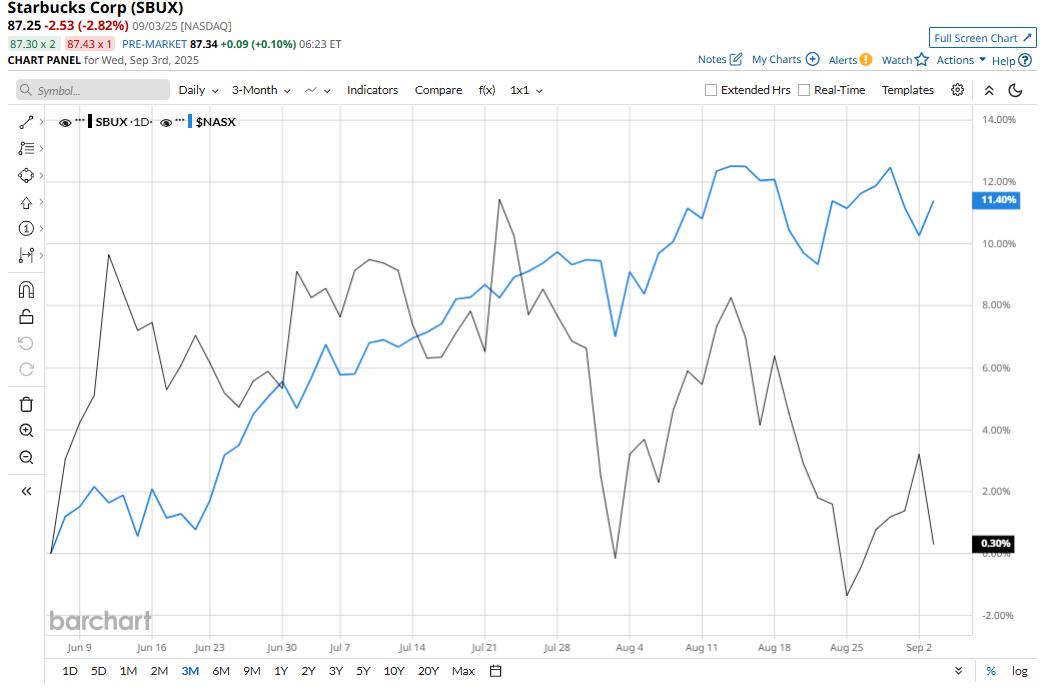

However, SBUX stock is sitting around 25.7% below its 52-week high of $117.46, reached on March 3. Shares of the coffee giant have gained just marginally over the past three months, underperforming the broader Nasdaq Composite’s ($NASX) 10.8% rise over the same time frame.

A similar trend is seen over the longer term. SBUX stock has declined 4.4% on a year-to-date (YTD) basis and 6.4% over the past 52 weeks, compared to the tech-heavy Nasdaq’s gains of 11.3% YTD and 25.5% over the past year.

To confirm the bearish trend, SBUX has been mostly trading below its 200-day moving average since the beginning of April, except for some fluctuations. Also, the stock has been trading below its 50-day moving average since mid-August.

Starbucks’ shares have slipped in 2025 largely due to underwhelming performance in its core U.S. market, where same-store sales and transaction volumes have continued to fall even as management pushes its costly “Back to Starbucks” revival strategy, with heavy investments in labor, store redesign, and brand experience weighing on margins and earnings. Investor confidence remains subdued as the company’s turnaround efforts have yet to translate into meaningful results.

For the fiscal third quarter ending June 29, 2025 (reported on July 29), Starbucks posted a 2% year-over-year (YoY) decline in global comparable store sales. U.S. comparable store sales also declined 2%, amid a 4% decline in comparable transactions. Consolidated revenue increased about 4% YoY to $9.5 billion, while non-GAAP EPS is down about 46% to $0.50.

SBUX also lagged behind its rival McDonald’s Corporation (MCD), which has delivered 9.1% returns YTD and 10.8% over the past 52 weeks.

Wall Street analysts are still moderately bullish on SBUX’s prospects. The stock has a consensus “Moderate Buy” rating from the 33 analysts covering it, and the mean price target of $97.70 suggests a potential upside of 12% from current price levels.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.