Analysts Love This 1 Car Stock Before October (Hint: It’s Not Tesla)

While Tesla (TSLA) often dominates headlines in the electric and luxury car space, another car stock is capturing strong analyst attention ahead of a key event in October: Ferrari N.V. (RACE) is a world-renowned luxury automotive company celebrated for its iconic sports cars, cutting-edge engineering, and rich racing heritage. The brand has become synonymous with exclusivity, performance, and Italian craftsmanship. Beyond its legendary Formula 1 presence, Ferrari operates as a high-margin luxury and lifestyle brand, balancing limited production with sustained global demand.

Founded in 1947 by Enzo Ferrari, it is headquartered in Maranello, Italy.

RACE Stock Volatility

RACE stock has shown strong positive momentum over the past week, gaining approximately 5.5%. Over one month, the stock posted a notable 13% rise, indicating short-term bullish sentiment. Its six-month performance, however, has been more volatile, falling roughly 4.5% from its July peak. Year-to-date (YTD), RACE remains in positive territory with a 16.6% increase.

Over the past 52 weeks, the stock has fluctuated but is up 1.75% from its levels of last year. This recent pattern reflects investor optimism but also points to volatility, typical of high-profile luxury automotive equities.

Ferrari Q2 Results

Ferrari N.V. posted Q2 2025 results on July 31, 2025, reflecting an earnings per share of €2.38 ($2.77), surpassing Zacks Investment Research's estimates of €2.32 ($2.70). Revenue reached €1.787 billion ($2.08 billion), slightly under the forecasted €1.79 billion ($2.08 billion), but still up 4.4% year-over-year (YoY). This marks another positive quarter for Ferrari, with EPS exceeding analyst expectations and revenue showing robust growth despite minor estimate shortfalls.

Diving deeper into the quarter’s financials, Ferrari maintained strong margins, with an EBITDA margin of 39.7% and an operating (EBIT) margin of 30.9%. EBITDA totaled €709 million ($825 million), EBIT was €552 million ($642 million), and net profit reached €425 million ($495 million). The company delivered 3,494 vehicles, preserving exclusivity through controlled volumes. Free cash flow generation was solid at €232 million ($270 million), and Ferrari ended Q2 with a healthy cash reserve, demonstrating sustained financial discipline and operational resilience.

Ferrari reiterated its full-year 2025 guidance with stronger confidence, targeting net revenues above €7 billion ($8.15 billion), EBITDA over €2.68 billion ($3.12 billion), EPS above €8.60 ($10), and industrial free cash flow exceeding €1.2 billion ($1.4 billion). This removes earlier margin risks after favorable U.S. tariff developments and emphasizes strategic discipline as Ferrari executes on its electrification and new model pipeline.

Ferrari Receives a Buy

Deutsche Bank has upgraded Ferrari N.V. to a “Buy” rating, with expectations rising ahead of the brand’s Capital Markets Day in October, when Ferrari is predicted to announce elevated financial objectives. These include adjusted EBIT margins surpassing 30% and a €3 billion ($3.49 billion) share buyback, a move that represents about 4% of Ferrari’s value.

Analyst Nicolai Kempf points to the impending 2026 debut of the F80 supercar, a high-end model anticipated to be a major driver of earnings, forecasting more than €450 million in additional profit, which would significantly outpace the contribution of its predecessor, the Icona Daytona SP3.

Kempf’s team sees this potential as not yet factored into the market’s estimates. They project that investor attention will pivot sharply toward 2026, as the F80’s impact becomes clearer. Positive news from the CMD, combined with an expected 5% consensus earnings upgrade for 2026, should reinforce the bullish outlook.

Overall, Deutsche Bank’s upgrade signals robust confidence in Ferrari’s trajectory, underlining the company’s ability to deliver sustained growth and profitability through strong demand and effective model strategy.

Should You Buy RACE?

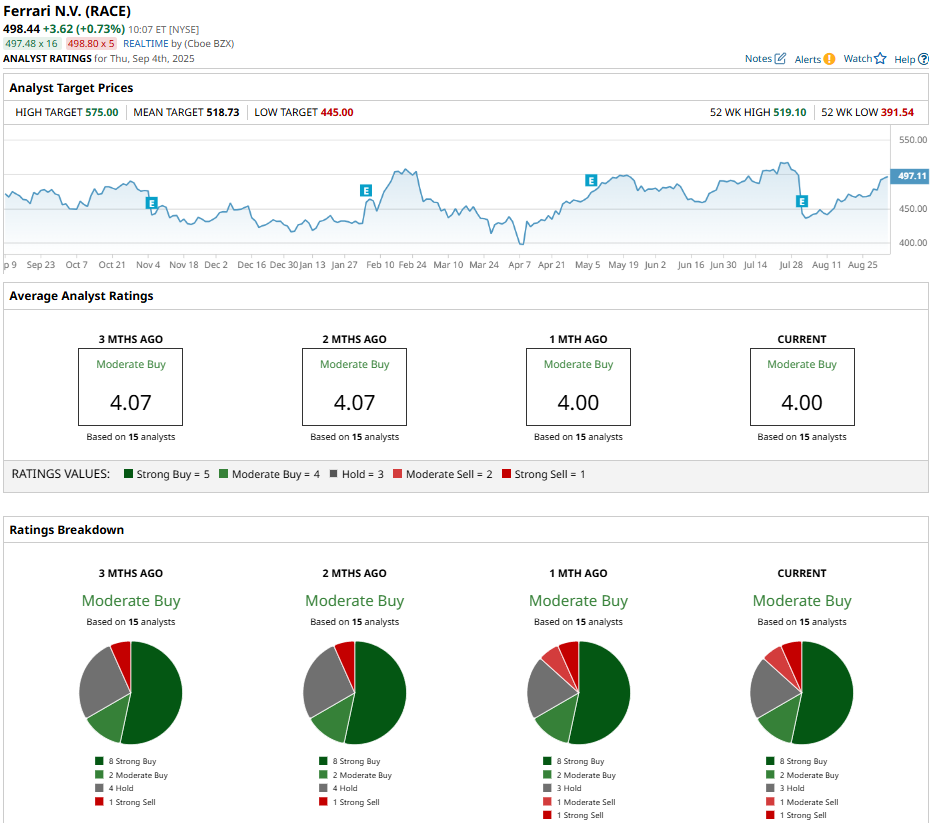

There is a mixed bag of reviews from Wall Street on the racing giant, with a consensus “Moderate Buy” rating (for comparison, TSLA has a “Hold”) and a mean price target of $518.73, reflecting an upside potential of 4.06%, indicating little breathing space from consensus.

The stock has been analyzed by 15 analysts so far, receiving eight “Strong Buy” ratings, two “Moderate Buy” ratings, three “Hold” ratings, one “Moderate Sell” rating, and one “Strong Sell” rating.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.