China’s ‘Dark Horse’ AI Startup Says It Will Use Domestic Chips, Not Nvidia’s, for Its Latest Models. What Does That Mean for NVDA Stock?

When it comes to artificial intelligence (AI), few companies have rattled Wall Street this year quite like DeepSeek. Dubbed China’s “dark horse,” the AI startup burst onto the scene in January with a breakthrough model that briefly shook up the global tech landscape, triggering a selloff in Nvidia (NVDA) and other AI-related stocks. At the time, however, fears quickly faded when investors realized the startup still depended heavily on Nvidia’s hardware to train and scale its models.

Now, the narrative may be shifting in a more concerning direction. DeepSeek recently hinted that its newest models will be "tailored" for domestically produced Chinese chips, not Nvidia’s. The company even said its precision format for the latest V3.1 model was designed with “next-generation” homegrown semiconductors in mind.

With that, let’s take a closer look at what this development could mean for NVDA stock.

About Nvidia Stock

Nvidia is a premier technology firm known for its expertise in graphics processing units and AI solutions. The company is renowned for its pioneering contributions to gaming, data centers, and AI-driven applications. NVDA’s technological solutions are developed around a platform strategy that combines hardware, systems, software, algorithms, and services to provide distinctive value. The chipmaker has a market cap of $4.15 trillion, making it the most valuable company in the world.

Shares of the AI darling have climbed 27.3% on a year-to-date (YTD) basis. NVDA stock recently came under pressure after reporting slightly weaker-than-expected Q2 data center revenue and issuing Q3 revenue guidance that fell short of investors’ lofty expectations.

China Remains a Headwind for Nvidia

Chinese AI startup DeepSeek, whose R1 reasoning model shook up the tech world and sparked a selloff in Nvidia and other tech stocks in January, recently hinted that China would soon produce domestic “next-generation” chips to power its AI models. In a comment on its official WeChat account, DeepSeek stated that the “UE8M0 FP8” precision format of its newly released V3.1 model is designed for the next-generation domestically produced chips set to launch soon. Notably, FP8, or 8-bit floating point, is a data format that can enhance computational efficiency in both training and inference of large deep learning models.

Chinese semiconductor stocks recently staged a massive rally on hopes that more chips used in China will be produced domestically. DeepSeek’s reference to China’s upcoming next-generation chips may indicate an intention to work more closely with the country’s growing AI chip ecosystem amid U.S. export restrictions on advanced semiconductors and Beijing’s push for chip self-sufficiency. Kevin Xu, founder of AI-focused fund Interconnected Capital, wrote in a blog post that this could enable Chinese AI developers to close the gap with the U.S. “sooner than most people think, credibly challenging Nvidia and the American AI stack both at home and abroad.” However, DeepSeek did not reveal which chips were used to train the V3.1 or specify which local chips the UE8M0 FP8 might be compatible with.

Meanwhile, as Chinese chipmakers and AI developers expand their arsenal of homegrown technology, Nvidia’s H20 chip, the most powerful AI processor it is allowed to sell in China, has been caught up in U.S.-China trade tensions. In July, U.S. President Donald Trump allowed Nvidia to resume H20 exports to China, overturning the ban that his administration had imposed in April. However, shortly afterward, Beijing told companies to hold off on purchasing the chips, citing potential security risks that Nvidia claims are unfounded. According to an official notice, Chinese regulators called in Nvidia representatives to discuss alleged “backdoor” security risks related to the H20 chips. Bernstein analyst Qingyuan Lin said that the outcome of China’s investigation into the “backdoor” issue could determine the fate of the H20.

Morningstar analyst Phelix Lee said that there is no guarantee Chinese-made chips will match Nvidia’s performance, comparing the localization push to “brute forcing its way through” complex computations. That said, demand for Nvidia’s H20 chip in China remains strong. During the Q2 earnings call, Nvidia CFO Colette Kress stated that the company could ship between $2 billion and $5 billion worth of H20 chips to China this quarter if U.S. regulatory and “geopolitical issues” are resolved. Analysts suggested that the geopolitical issues likely refer to Chinese authorities pressuring domestic firms to avoid purchasing Nvidia chips. Notably, Nvidia reported no new sales in China last quarter and expects zero AI chip sales to the country this quarter as well.

Still a Vital Market

Well, I view China as an important market for Nvidia. We clearly saw this importance reflected in Nvidia’s Q2 earnings report. The company’s Q2 data center revenue of $41.1 billion slightly missed consensus estimates, contributing to the post-earnings drop (along with Q3 revenue guidance that many considered soft, once again, mainly because China sales were accounted for as zero), as it took an approximately $4 billion hit from being unable to ship a single H20 chip to China during the quarter. Moreover, during the Q2 earnings call, Nvidia CEO Jensen Huang emphasized China’s importance to the company’s future, noting that the market could represent a $50 billion opportunity for Nvidia with 50% annual growth, while also stating there’s a “real possibility” of selling its advanced Blackwell processor there.

Meanwhile, Reuters reported in August that Nvidia is working on a new AI chip for China built on its latest Blackwell architecture, designed to be more powerful than the H20 model, which is based on the company’s previous-generation Hopper platform. The new chip, provisionally named the B30A, will feature a single-die design expected to provide about half the raw computing power of the more advanced dual-die setup in Nvidia’s flagship B300 accelerator card. U.S. President Donald Trump has hinted that he may permit more advanced Nvidia chips to be sold in China, but the report, citing sources, noted that U.S. regulatory approval is still far from certain.

So, essentially, we’re left with two clear options here. First, if the restrictions imposed by President Trump are eased, China stops discouraging domestic companies from purchasing Nvidia chips, and broader U.S.-China trade negotiations succeed, then the uncertainty surrounding China will fade, enabling the company to keep benefiting from sales in the country, which accounted for 13% of Nvidia’s revenue in the last financial year. Notably, in August, CEO Huang reached an agreement with President Trump to resume sales to China by agreeing to give 15% of sales in the region to the government. The key point, however, is that the deal has not yet been finalized. And the second option is that everything stays as it is, with China’s AI startups like DeepSeek continuing to rely more on domestic hardware for future model development. In that scenario, Nvidia would remain shut out of the world’s second-largest computing market, forfeiting billions in potential revenue—an outcome that would clearly be negative for the company.

Of course, Nvidia will still be able to grow at a solid pace. However, it would likely be harder for it to meet investors’ lofty expectations without access to the Chinese market, which I view as one of its growth drivers.

What Do Analysts Expect for NVDA Stock?

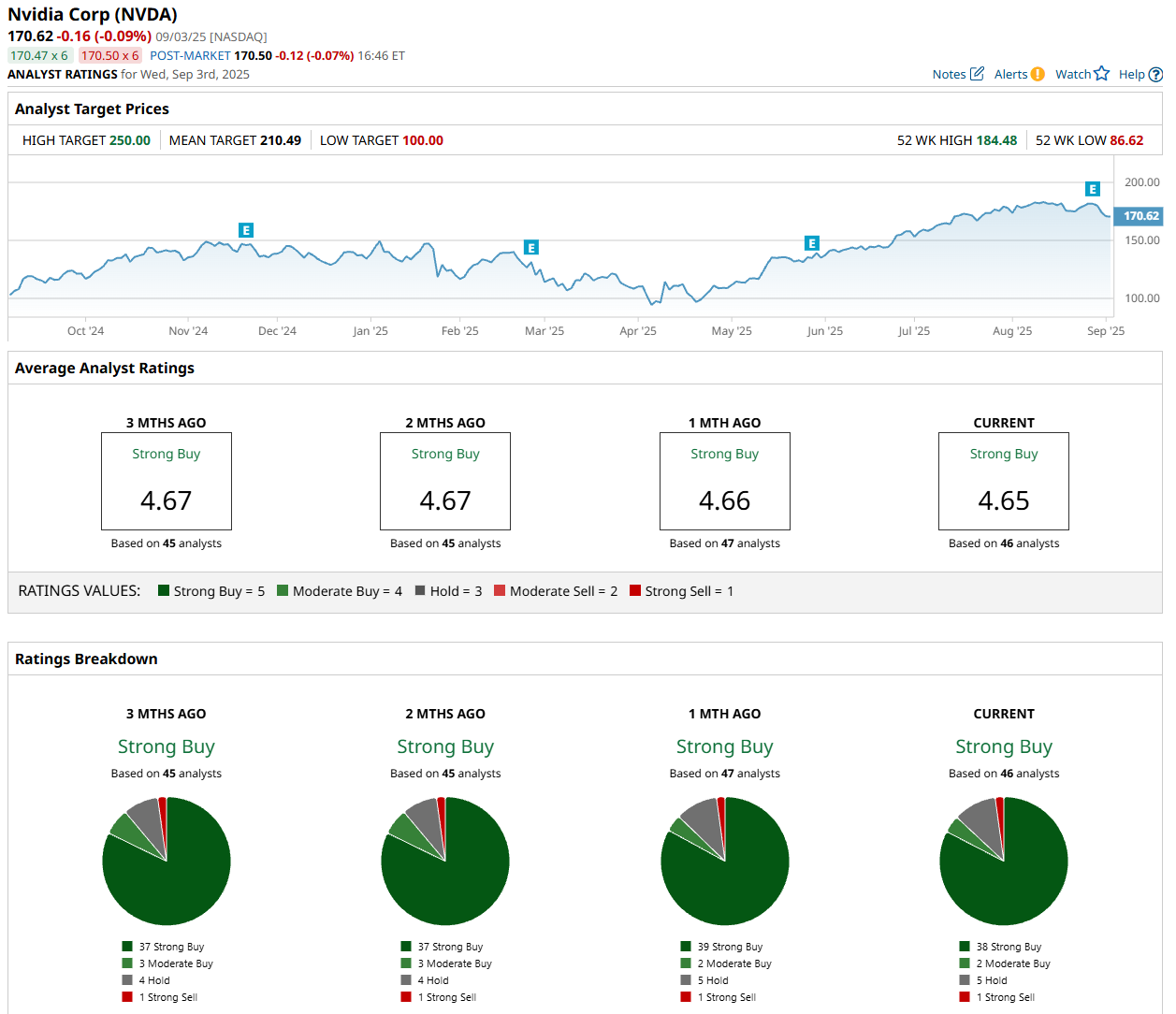

Wall Street analysts remain very optimistic about Nvidia’s growth outlook, as shown by its top-tier “Strong Buy” consensus rating. Of the 46 analysts offering recommendations for the stock, 38 rate it as a “Strong Buy,” two suggest a “Moderate Buy,” five recommend holding, and one gives it a rare “Strong Sell” rating. The mean price target for NVDA stock is $210.49, suggesting a potential upside of 23.4% from current levels.

On the date of publication, Oleksandr Pylypenko did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.