American Eagle Is Doubling Down on Sydney Sweeney. Should You Buy AEO Stock Here?

American Eagle (AEO) shares soared as much as 35% this morning after the fashion retailer said its recent Sydney Sweeney ad campaign generated “unprecedented new customer acquisitions.”

While the aforementioned campaign featuring the “Euphoria” actress sparked controversy, the firm’s management confirmed today that it’s “not going anywhere.”

In fact, AEO will soon “introduce new elements of the campaign,” according to Craig Brommers, its chief of marketing. Including today’s surge, American Eagle stock is up nearly 100% compared to its June low.

Sweeney Effect May Push American Eagle Stock Up Further

AEO partnered with NFL legend and popstar Taylor Swift’s fiancé, Travis Kelce, as well in August.

Together, the Sweeney and Kelce ad campaigns have generated a whopping 40 billion impressions, helping the company increase its overall customer count by more than 700,000 in about six weeks.

The campaigns helped American Eagle’s revenue print at a better-than-expected $1.28 billion in its fiscal Q2, indicating “marketing momentum is translating into sales,” according to Lale Akoner, an eToro analyst.

And as the retailer delivers on its promise of doubling down on the Sydney Sweeney ad campaign, chances are that it will continue to see outsized engagement and top-line growth, leading AEO stock higher from here.

Here’s Why AEO Shares Still Aren’t Worth Buying

While celebrity-led campaigns may prove a long-term tailwind for American Eagle stock, Michael Ashley Schulman continues to recommend caution in buying it at current levels.

According to Running Point Capital’s chief of investments, AEO shares at a forward price-earnings (P/E) multiple of nearly 17x already bakes in a lot of the expected increase in demand from these ad campaigns.

Peers Abercrombie & Fitch (ANF) and Urban Outfitters (URBN) are currently going for less than 8x and about 12x, respectively. Short interest in American Eagle shares also currently sits at more than 18%, further signaling bearish sentiment among traders.

Wall Street Remains Bearish on American Eagle Shares

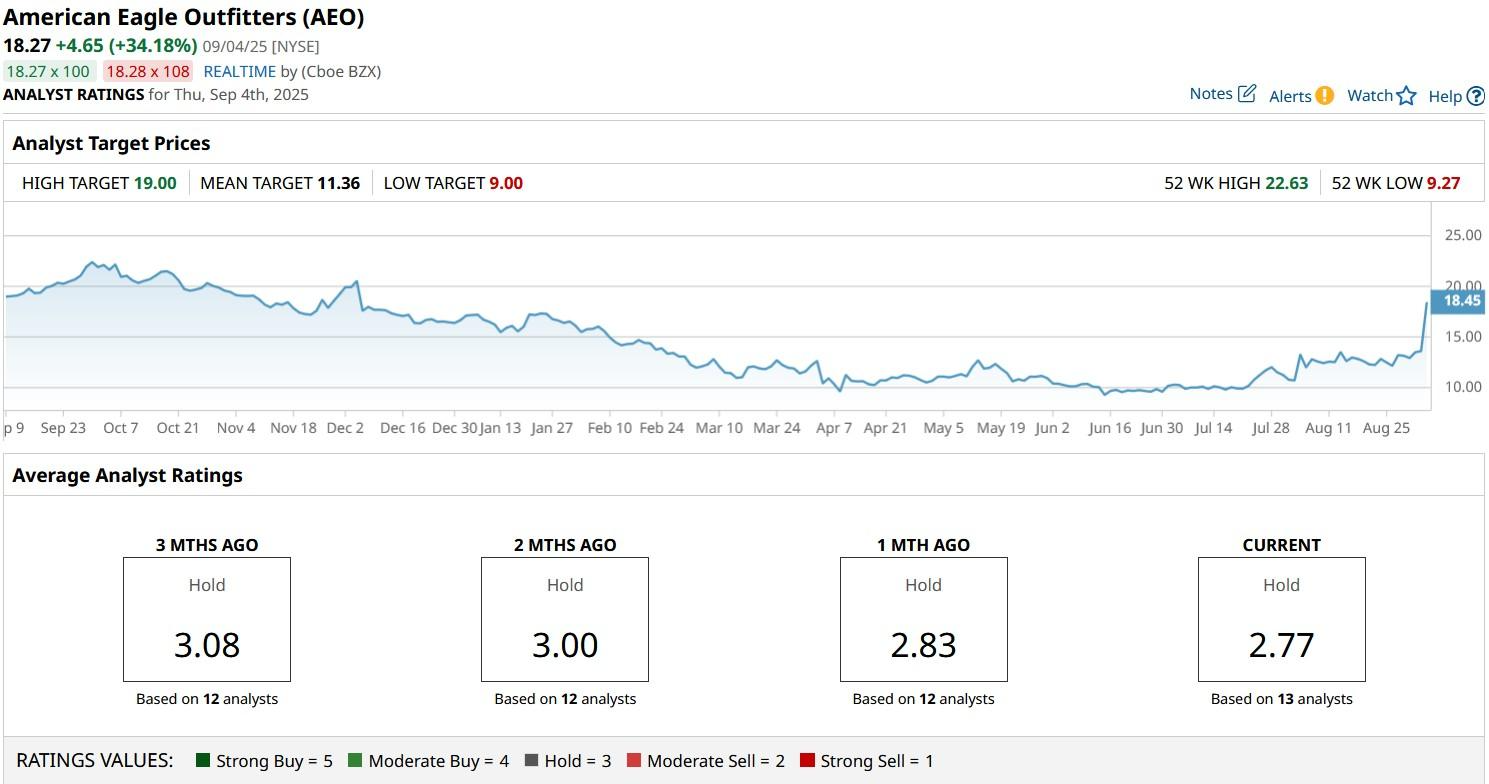

Despite the management’s upbeat commentary, Wall Street analysts remain super bearish on AEO shares.

The consensus rating on American Eagle stock currently sits at “Hold” only with the mean target of $11.36 indicating potential downside of more than 30% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.